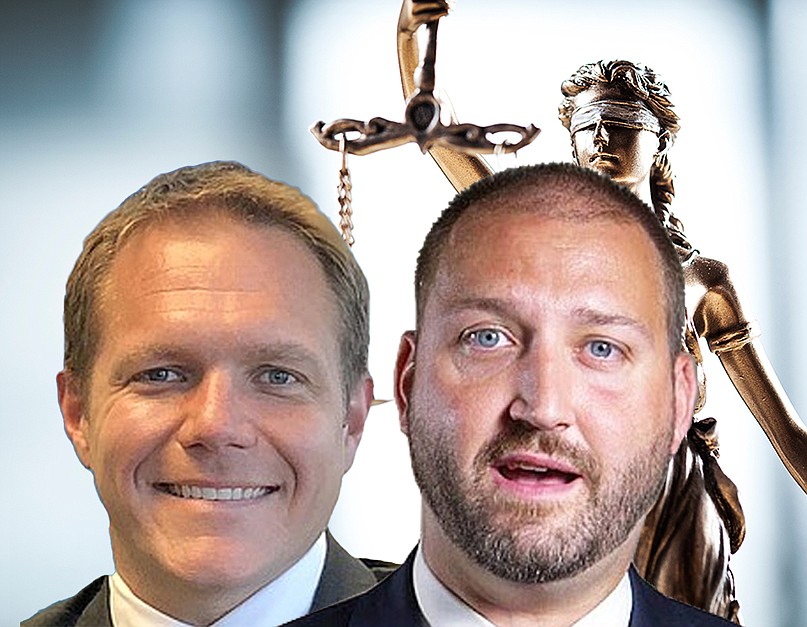

Three former JEA board members testified in the criminal trial of former JEA executives Aaron Zahn and Ryan Wannemacher that they would not have voted for an employee incentive plan in 2019 if they had known it would potentially pay out hundreds of millions of dollars with a sale of the city-owned utility.

Andy Allen, Kelly Flanagan and Fred Newbill were on the board July 23, 2019, when it approved what was known as the performance unit plan, or PUP.

The stated purpose of the plan was to offer employees performance units, which were similar to stock in a private company, as a way to motivate the staff to excel in their jobs and improve the utility’s financial performance.

The units were to be sold for $10 apiece, and their value would increase or decrease with the company’s financial performance.

The government claims Zahn and Wannemacher conspired to create an incentive plan that was weighted toward themselves and other high-ranking executives.

As alleged by prosecutors, the two hid the fact that the plan would pay them tens of millions of dollars if the utility were privatized, then created a false impression of JEA as a failing business to convince board members it must be sold.

PUP payouts

Responding to questions from a federal prosecutor Feb. 27, Newbill said he believed the PUP would pay a maximum of $3.4 million across all of the plan participants over a three-year period. He said he considered that a reasonable amount.

Assistant U.S. Attorney Chip Corsmeier then showed him calculations that the performance units would pay as much as $345 million if JEA were sold.

If that had been explained to him, Corsmeier asked, would Newbill have voted for the plan?

“No,” he said.

Flanagan offered similar testimony, saying the JEA executive team had provided “no examples in terms of the math or arithmetic associated with” a sale of JEA on the PUP.

Allen, when asked if he’d been shown any calculations or math associated with a sale or privatization, said no.

Jurors were shown a clip of the July 2019 meeting showing Flanagan asking Wannemacher about how the incentive plan would be affected by a proposal to privatize JEA through a sale to a private company, putting up the business for an initial public offering, transitioning to a cooperative or some other method.

Wannemacher’s answer was that a sale would end the plan period, but he did not mention a significant increase in value of the units.

“I’m not sure I had a perfect understanding (of the situation) relying on the verbal representation of management,” Flanagan testified.

No questions raised

Defense attorneys for Zahn and Wannemacher asked the former board members why they didn’t seek more information about the plan.

Under questioning by Brian Albritton, who is representing Zahn, Newbill noted that he grown to trust Zahn while serving with him on the board.

Zahn was appointed to the board in February 2018 before being named interim CEO in April of that year and then becoming full CEO in November 2018.

“You could have inquired to Mr. Zahn?” Albritton said.

“Yes,” Newbill said.

“And you weren’t limited to Mr. Zahn?”

“No.”

“As a board member, you could have inquired to board counsel if you’d had any questions, right?”

“Yes.”

In other testimony, a consultant who worked with JEA to enhance its business model said he was surprised when Zahn notified him by email in June 2019 that the management team planned to privatize the city-owned operation.

McKinsey and Co. consultant

Anton Derkach, a senior partner with the McKinsey and Co. management consulting firm, told jurors that McKinsey had been working with JEA since December 2018. At that time, Derkach said, he and his colleagues were told that privatization was “in the rearview mirror” after being considered earlier that year.

Derkach said McKinsey’s aim was to make JEA “the municipal utility of the future.” The consulting company helped JEA develop two scenarios, including one in which the operation maintained status quo and another involving measures like rate increases, cost reductions and reductions in capital expenditures.

Then came a June 2019 email from Zahn saying the executive team was considering privatization.

“Until that moment we had not had conversations about privatization of JEA other than in December 2018,” Derkach testified.

Council auditor testifies

Also on Feb. 27, City Council Auditor Kyle Billy testified about a memo he issued Nov. 18, 2019, showing that the value of the performance units was potentially drastically higher than originally believed. That memo came days after Zahn announced that JEA leadership was indefinitely postponing implementation of the PUP.

That memo was followed by a series of events that would include a special City Council committee holding public hearings on concerns over the situation.

By the end of 2019, the JEA board rescinded the bonus plan, halted the sale process and fired Zahn.

Eddie Suarez, who is representing Zahn, questioned Billy on several aspects of the memo, including his conclusions.

The questioning led to terse exchanges at times. Suarez and Billy went back and forth over Billy’s calculations, with Suarez pressing Billy about whether he included JEA’s obligations and liabilities in determining the net value that the utility would have provided to the city if it had been sold.

Billy said he followed the formula that was approved by the JEA board.

“Is it accurate to say you didn’t consider any debts and obligations?” Suarez said.

“I’m not sure that’s accurate to say. We followed the formula to the T. It’s a contractual formula,” Billy said.

“You use this term of net proceeds: That’s gross value minus liabilities and obligations? Did you consider any debt and obligations?” Suarez said.

“We considered everything that was mentioned – everything in the formula that was considered by the JEA board,” Billy said.

Taking aim at a government narrative that Zahn and Wannemacher tried to shroud their activities, Suarez questioned Billy about the former executives’ response to inquiries from the auditor’s office leading up to Billy’s memo.

Meeting granted

After emailing questions to JEA in early August 2019, Billy said, his office agreed to circle back in a few weeks to give the auditors time to work on time-sensitive budget issues for the city.

When auditors emailed the JEA on Oct. 30 seeking a meeting, Billy said, JEA agreed to meet the next day.

“When you asked them for a meeting, they met the very next day?” Suarez said.

“Yes,” Billy said.

Billy’s team followed that meeting by emailing a second round of questions to JEA.

Billy said he issued the Nov. 18 memo because the sale process of JEA appeared to be moving quickly and the auditor’s office had been “waiting since August” for responses from the utility.

“You keep saying you’d been waiting since August, but you agreed to circle back,” Suarez said.

“A few weeks would have still been August,” Billy said.

The trial, which began with jury selection Feb. 15, is being held in the Bryan Simpson U.S. Courthouse. The defendants are charged with wire fraud and conspiracy, which carry prison terms of up to 20 years and up to five years, respectively.

Testimony from government witnesses is scheduled to resume Feb. 28.