Duos Technologies Group Inc. went into 2024 as a company focused mainly on advanced railroad technology but when it reported first-quarter earnings in May, it announced a new business line called Duos Edge AI.

As it announced second-quarter earnings Aug. 13, Jacksonville-based Duos announced a third business line called Duos Energy Corp.

Duos Edge AI provides artificial intelligence data centers in rural markets.

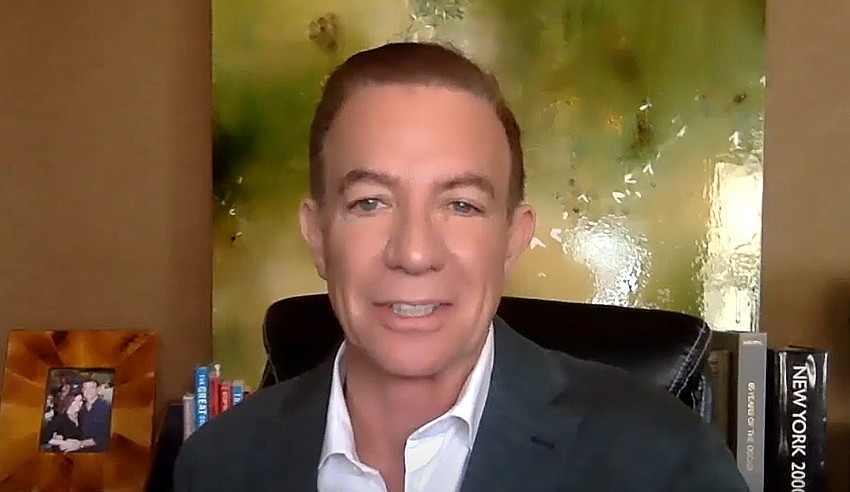

“With our entry into the data center space, we are now receiving requests to participate and, in some cases, lead opportunities to install power in support of data centers here in the United States,” CEO Chuck Ferry said in a conference call, according to a company transcript.

“Based on this growing demand, we have incorporated Duos Energy Corporation as a third subsidiary to our Duos Technologies family and already have a small pipeline of projects in support of data centers that could further accelerate our plan for more recurring revenue and profitability,” he said.

It is a logical move for Ferry who, before joining Duos, was CEO of Jacksonville-based fast-track power plant company APR Energy.

He left APR when it was acquired in 2020 by Atlas Corp. and Ferry said Duos, with a total staff of about 70, has about 15 former APR employees.

Duos’ railroad technology has been producing disappointing results in recent years. The company said second-quarter revenue fell 15% to $1.51 million and it recorded a net loss of $3.2 million.

All of the revenue came from the railroad division.

Ferry said as Duos expands into new businesses, it remains committed to the rail technology.

“There is strong evidence from across the rail industry that this technology will eventually be deployed in high numbers, benefiting everyone,” he said.

Duos said it has a backlog of $19.6 million in revenue and expects to recognize $6.9 million of that in the second half of this year.

Jacksonville-based space technology company Redwire Corp., which completed nine acquisitions from 2020 through 2023, announced a 10th deal Aug. 14.

Redwire said it agreed to acquire Hera System Inc., a San Jose, California-based company that develops spacecraft focused on specialized missions for national security space customers.

“This transaction fits squarely within our growth strategy by adding significant capabilities to move up the value chain in select areas of emerging hybrid architectures,” CEO Peter Cannito said in a news release.

Hera had $15 million in revenue last year. Redwire was projecting total revenue, without Hera, of $300 million this year.

Terms of the deal were not announced.

Proficient Auto Logistics Inc. said in an Aug. 14 Securities and Exchange Commission filing that former CSX Corp. executive Amy Rice joined the company as president and chief operating officer, succeeding the retiring Randy Beggs.

Jacksonville-based Proficient was formed by merging five automobile companies together in May after an initial public offering.

Beggs had been CEO of one of the five companies, Jacksonville-based Proficient Auto Transport Inc., since April 2018. He became CEO of Proficient Auto Logistics after the IPO.

Rice served in various roles at Jacksonville-based CSX from 2011 through 2019, when she served as vice president for coal and intermodal operations.

She was CEO of Sy-Klone International, a manufacturer of fine dust filtration systems, from 2019 through May 2023.

Executives of Sotherly Hotels Inc., which announced plans in July to reposition the DoubleTree by Hilton Jacksonville Riverfront into a new concept, is encouraged by the upcoming renovation of EverBank Stadium across the river.

“We really think there’s a big market opportunity in Jacksonville,” Executive Vice President and Chief Operating Officer Scott Kucinski said in Sotherly’s quarterly conference call with analysts Aug. 13.

“The Jaguars just announced a multibillion dollar complete transformation of their stadium right there in Downtown that’s definitely going to be bringing some larger events, Super Bowls, and that type of thing in the future,” he said.

“There’s a lot of development activity without really any of the hotels, except for Four Seasons that’s going to be built over by the stadium coming downtown.”

Jaguars owner Shad Khan’s company is building the Four Seasons Hotel and Private Residences on the Northbank near the stadium.

Sotherly announced a $14.6 million renovation project in July for the DoubleTree at 1201 Riverplace Blvd. on the Downtown Southbank, which will be rebranded as the Hotel Bellamy.

“We’re excited to kind of put some more money into that asset and position it for some really good growth in the future,” Kucinski said.

“So $14.6 million, that’s a full repositioning, re-envisioning,” he said.

The project is scheduled to begin early in 2025 and be completed in early 2027, he said.

Virginia-based Sotherly owns 12 hotels.

The company reported the 293-room DoubleTree had occupancy of 71.6% in the first half of this year, while its entire portfolio had occupancy of 69.2%.

GEE Group Inc. reported lower revenue and a net loss for its third quarter ended June 30, but the Jacksonville-based staffing company is taking steps to expand the business.

Revenue for the quarter dropped 23% to $29.5 million, and the company recorded an adjusted net loss of $3.8 million.

“In fiscal 2024, we have encountered and continue to face very difficult and challenging conditions in the hiring environment for our staffing services stemming from macroeconomic uncertainty, interest rate volatility and inflation leading to a less than robust economy and slowdowns in the labor market,” CEO Derek Dewan said in an Aug. 15 conference call, according to a company transcript.

“These conditions have produced a near universal cooling effect on U.S. employment, including businesses’ use of contingent labor and the hiring of full-time personnel,” he said.

However, GEE Group is taking steps to position itself for a turn in the market, Dewan said.

“We are by no means operating under any sort of wait-and-see posture and are taking aggressive actions to improve our financial results, both short-term and long-term,” he said.

“We are taking this opportunity to ramp up our M&A activities and at the same time, streamline our operations while taking out an estimated $3.0 million in annual SG&A costs in the process.”

Dewan said GEE Group is in contact with several acquisition targets “and (we) expect to complete accretive transactions within the remainder of this calendar year and in fiscal 2025.”

Cadre Holdings Inc. said in its second-quarter earnings report that a cyber incident July 15 has been contained, and the company has resumed or is resuming all affected operations.

The Jacksonville-based company, which makes safety and security products for first responders, said the incident temporarily limited production. That may affect its financial results for the third quarter, but company officials said in an Aug. 12 conference call it expects any lost revenue from the incident will be shifted into the fourth quarter.

Cadre reported second-quarter sales rose 19% to $144.3 million and earnings rose by 2 cents a share to 31 cents.

CEO Warren Kanders said in the conference call that macro trends are fueling demand for its products.

“Public safety spending has only trended upwards and ongoing conflicts in Ukraine, the Middle East and elsewhere underscore the importance of the work that we do,” he said.

LFTD Partners Inc. reported a second-quarter net loss of $523,211, with revenue falling 24% to $9.5 million.

Jacksonville-based LFTD’s main business is a Kenosha, Wisconsin, company called Lifted Made, which manufactures and sells hemp-derived and other psychoactive products.

In an Aug. 15 conference call, LFTD President Jake Jacobs said the company faced several headwinds that reduced sales.

“Firstly, prohibition of or tighter regulation of intoxicating hemp-derived products has been adopted or proposed in many states that are significant markets for Lifted such as Missouri,” Jacobs said.

“There is also greater competition in the marketplace for branded hemp-derived and psychoactive products. More distributors are creating their own brands, selling their own branded products at low prices,” he said.

CEO Gerard Jacobs, Jake’s father, said the company is looking at opportunities to expand the business beyond Lifted Made.

“We have been engaged in a number of discussions regarding potential acquisitions, both within and outside the hemp industry,” he said.

“These discussions are ongoing and at this point in time, are including a discussion with a fund that has expressed an interest in potentially backing acquisitions by LFTD Partners.”

He said there is no assurance the discussions will be successfully concluded.

ParkerVision Inc. reported a net loss of $327,000 for the second quarter as the developer of wireless technology, with no products on the market, continues to pursue patent infringement claims against several companies.

“The next twelve months promise to be active as we have four scheduled jury trials in our patent infringement cases in the Western District of Texas,” CEO Jeff Parker said in an Aug. 13 news release.

ParkerVision, which alleges several major telecommunications manufacturers have illegally used its patented technology, has claims pending in Texas against Texas Instruments, NXP Semiconductors, MediaTek and Realtek, the company said.

Parker said the company is also expecting a ruling soon from a federal judge in Orlando in a lawsuit against Qualcomm.