In a deed-in-lieu of foreclosure, new owners took control of the signature Wells Fargo Center in Downtown Jacksonville and said they will continue the capital improvement plan that began under previous ownership.

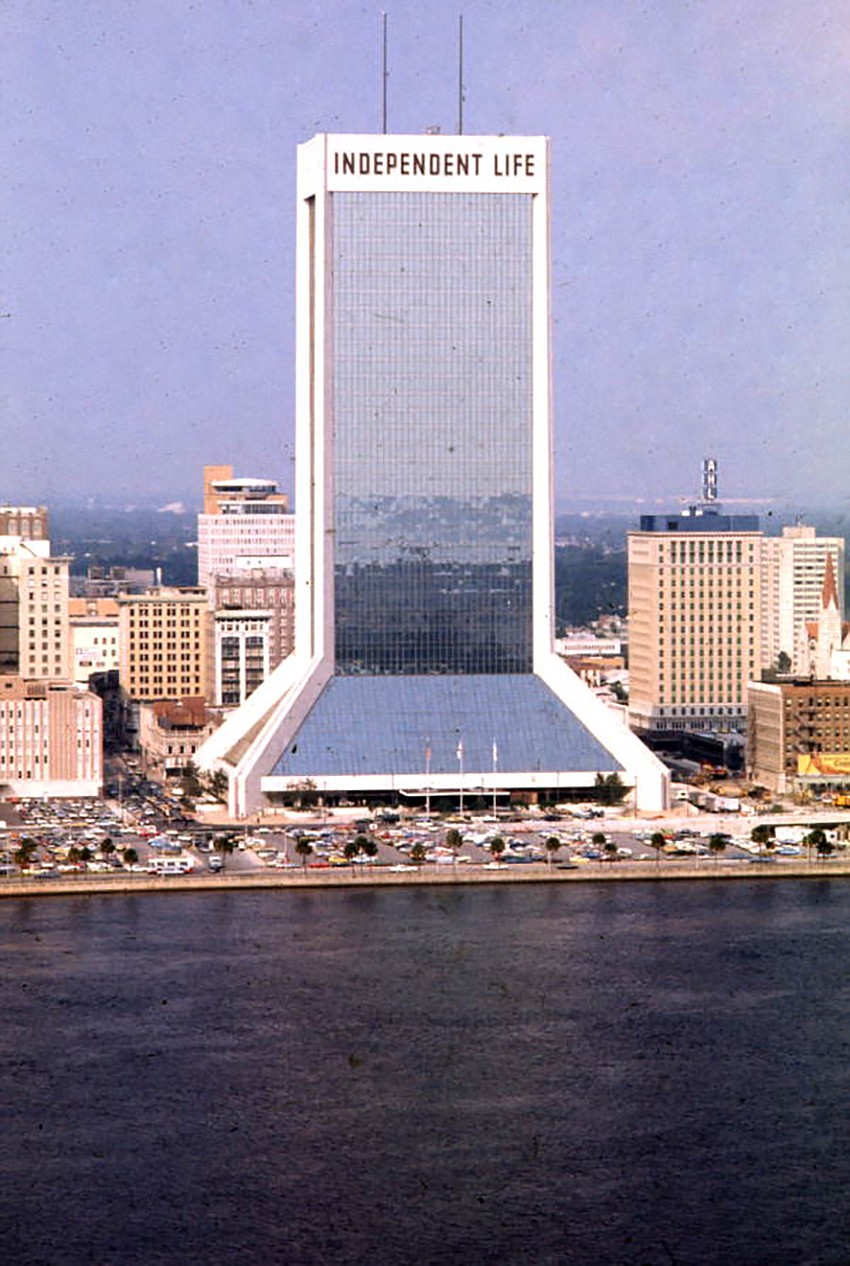

The group also indicated there could be a new name on Jacksonville's 37-story Northbank waterfront high-rise. It would be the fifth name in almost 50 years since the tower was built for Independent Life in 1975.

An entity managed by Argentic Investment Management LLC of New York City said April 26 it acquired the Wells Fargo Center with plans to continue investments “in the iconic, 37-story office tower.”

Argentic said it will “market the tower’s building-top signage opportunity and is already in discussions with two financial institutions.”

“This comes as Wells Fargo plans to downsize and extend its lease at the property, which will take place in October 2024,” the release said.

“This is one of the most iconic and visible building top signs in the Southeast, and it represents a tremendous opportunity for a tenant desiring national exposure to accompany a large format lease,” said Zac Gruber, president of Banyan’s Office Division.

Management team retained

Argentic announced the former owner, Banyan Street Capital, has been retained as the exclusive owner’s agent “and will provide best-in-class management services.”

Argentic said it plans to invest funds to continue the path of stabilizing the tenancy and finalizing capital improvements that began under Banyan’s ownership.

Argentic said it also purchased two parking garages as part of the acquisition.

“The team overseeing the property will remain in place, providing continuity and reliability for all tenants, employees and guests of Wells Fargo Center,” said a representative of Argentic in the news release.

Encompassing an entire city block next to the Riverwalk, “Wells Fargo Tower spans 655,000 square feet with striking architecture that stands out as an icon in the Jacksonville skyline.

“The building features magnificent water views, high-end amenities, and walkable attractions. The top two stories of the tower are dedicated to the River Club, a unique, members-only experience originally founded as a business club in 1954 to rival similar private clubs in New York, Chicago and Washington, D.C.,” the release said.

It directs questions to wellsfargocenterjax.com.

Founded in 2012, Banyan Street Capital is a Miami-based real estate investment firm with regional offices in New York City, Atlanta and Jacksonville.

It owns, develops and operates a portfolio of office, multifamily and mixed-use properties comprising 9.7 million square feet of office space, 6,000 apartment units and almost 42,000 parking spaces across the Eastern U.S.

Argentic Investment Management is an investment manager of commercial real estate lending and investment vehicles focused on providing fixed-rate and floating-rate debt financing solutions to property owners throughout the U.S.

The transaction

As reported, ownership of the Wells Fargo Center conveyed the Downtown tower and two parking garages April 22 to Argentic at a value of a combined $46.35 million.

A New York City-based limited liability company led by the CEO of Argentic Investment Management LLC now owns the tower at 1 Independent Drive.

The deed shows that WFC Lessee LLC, led by Banyan Street Capital LLC of Miami, conveyed the property to AREIT RE WFC LLC.

That LLC is led by Doug Tiesi, CEO of Argentic Investment Management.

The two special warranty deeds were recorded April 24 with the Duval County Clerk of Courts for the tower, a nine-level garage at 1 W. Bay St. and a three-level garage at 21 E. Bay St.

The almost 900,000-square-foot tower, whose leasable space is less than 700,000 square feet, and the nine-level garage were conveyed at $41.715 million and the three-level garage at $4.635 million, the deeds show.

Last sold in 2014

The sale comes 10 years after the property last sold.

The tower is almost 50 years old. The nine-level garage is 35 years old and the three-level garage is 48 years old.

In 2014, a group of New York and Miami investors partnered to pay $75.3 million for the tower.

Allegiance Partners of New York paid $44.75 million. Banyan Real Estate Capital paid $30.55 million.

The nine-story parking garage was included in the purchase of the building.

The investors separately paid $3.7 million for the three-story parking garage.

The deeds recorded April 22 indicate that Banyan sold the buildings "on or upon" the land.

The deeds say the property conveyed "expressly excludes any interest in the land ... owned by Allegiance Jacksonville LLC."

That indicates Allegiance owns the ground the buildings occupy and that Argentic will lease that land.

Cushman & Wakefield had the listing on the property.

Landmark tower

The building is considered one of Jacksonville’s most recognized buildings and is used in skyline shots of the city.

The tower was built in 1975 as the headquarters for Jacksonville-based Independent Life & Accident Insurance Co. and was known as the Independent Life Building.

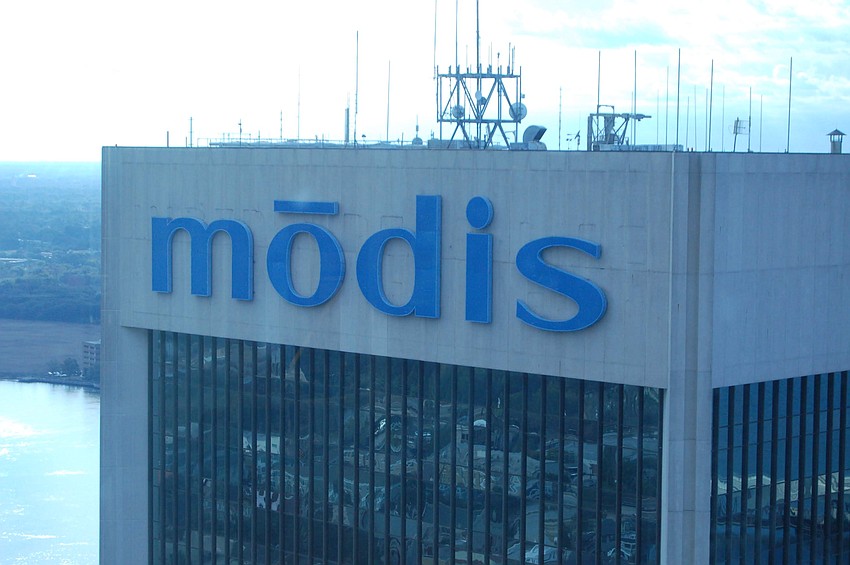

It became the AccuStaff Building starting in 1998 and later the Modis Building before Wells Fargo became the anchor tenant in 2011.

In 2021, owners began a $12.5 million lobby, cafe and common area renovation along with elevator upgrades in the tower.

The element likely best known to visitors the past few decades - the lobby plants, rocks, water features and bubbling fountains - were removed and replaced with new furniture, open seating, terrazzo floors and other up-to-date elements.

The property has been for sale, such as in 2019 when owners sought offers from investors. Market sources have talked about the potential sale for months.

About 88% leased

Office space on the Downtown Northbank is more than 20% vacant, according to first-quarter market industry reports. Ranges are 20% to almost 28%, depending on the method of calculation.

Sources say the Wells Fargo Center is about 88% leased. Wells Fargo is downsizing, as the news release said.

About Argentic

Argentic says on its website, argenticmgmt.com, that it is the manager of commercial real estate lending and investment vehicles focused on providing fixed-rate and floating-rate debt financing solutions to property owners throughout the United States.

It says it is led by industry veterans with expertise in all aspects of commercial real estate, including loan origination, structuring, underwriting, credit, asset management and capital markets.

"As a direct lender, Argentic provides fixed-rate permanent financing, floating-rate transitional financing and subordinate debt financing secured by various types of properties including retail, office, industrial, multifamily, self-storage, hotel, mobile home parks and student housing," it says.

The site says that through investments in noninvestment grade CMBS, Argentic or its affiliates act as the directing certificate-holder on an increasing number of CMBS transactions, providing approval for certain major decisions throughout the life of the investments.

CMBS are commercial mortgage-backed securities, defined as fixed-income investment products backed by mortgages on commercial properties rather than residential real estate.

CMBS provide liquidity to real estate investors and commercial lenders.

Argentic is headquartered in New York City, with offices in Los Angeles, Chicago and Dallas.