A revamped $36.55 million city incentives deal for developer Steve Atkins’ plan to redevelop the historic Laura Street Trio could face opposition when it heads to the Downtown Investment Authority board June 21.

The DIA Strategic Implementation Committee voted 3-1 June 15 in favor of the financing package, but some board members questioned whether the proposal, plus Atkins’ request for $27 million more from City Council, is asking too much from Jacksonville taxpayers.

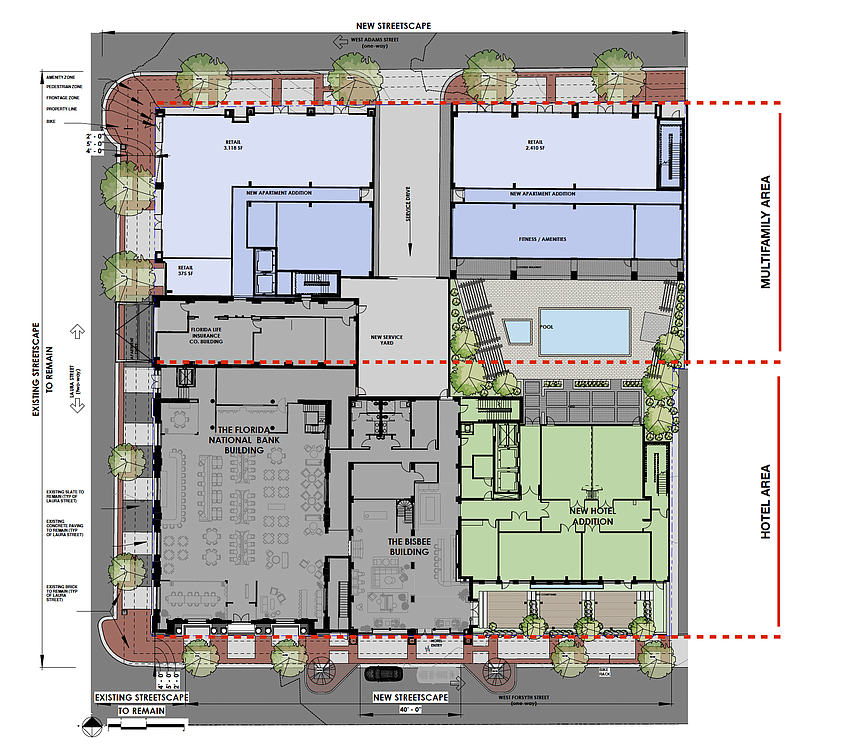

Atkins, principal of SouthEast Development Group and the Trio owner, is seeking a new incentives deal for a scaled-up $175.1 million multifamily, hotel and restaurant development plan for the Trio property he announced in April.

The changes required DIA officials to redraft Atkins’ previous redevelopment agreement for $26.67 million in incentives approved by City Council in September 2021 when the plan was a $70.48 million hotel and restaurant without the apartments.

Committee Chair W. Braxton Gillam, who voted no, said it hurts the DIA’s autonomy as an investment agency if it approves money for a project knowing it’s not enough to close the financial gap to make the project viable.

“It’s a project I really want to see happen,” Gillam said. “It makes the problem worse long-term if we start supporting projects where we give them all we can and then go to the city to get the rest. I can’t support it for that reason.”

Atkins purchased the Trio, built from 1902-1912 at Laura, Forsyth and Adams streets, in 2013. It comprises the Florida National Bank, Bisbee and Florida Life Insurance buildings.

Many historic preservation advocates and city officials consider it a key project to Downtown Jacksonville’s revitalization.

“This project is probably, in terms of our historic preservation and in Downtown, one of the most important,” board Chair Carol Worsham said.

“I think it would be a crime for those properties to stay vacant and not be renovated. … I just can’t imagine turning our backs on this project at this point,” she said.

Worsham and board members George Saoud and Craig Gibbs voted to advance the deal June 15. Board member Joshua Garrison, who attended the meeting virtually, said he had concerns and needed to think further about the proposal before commenting.

Members Oliver Barakat and Joe Hassan were not at the meeting.

Atkins’ latest pitch would transform the trio into a 143-room, four-star Marriott Autograph Collection Hotel; a restaurant and bar open to hotel patrons and the public; and 169 apartments with market rate and workforce housing units.

He is developing the hospitality component under Laura Trio LLC and the multifamily under The Residences at Laura Trio LLC.

The project is designed by Dasher Hurst Architects.

Deal breakdown

If approved, the DIA and city deal would offer $36.55 million in forgivable and deferred principal loans through the DIA’s Downtown Preservation and Revitalization Program and property tax breaks.

The incentives would be split between $21.68 million for the hotel and restaurant and $14.87 million for the Residences at Laura Trio multifamily, according to the term sheet and DIA staff report.

Between the historic Marble Bank building and Bisbee building, which would house part of the hotel and restaurant, the developer would receive:

• $7.46 million in Historic Preservation, Restoration and Rehabilitation Forgivable loans.

• $5.35 million in Code Compliance Forgivable Loans.

• $3.20 million in deferred principal loans.

The DIA deal would offer a $5.67 million Recapture Enhanced Value Grant property tax refund for the hotel’s new construction component. That’s a 75% refund of the ad valorem tax increase generated by the property over 20 years.

For the apartments in the Florida Life Insurance Building, the deal would offer:

• A $2.84 million Preservation, Restoration and Rehabilitation Forgivable loan.

• A $1.98 million Code Compliance Loan.

• A $1.20 million deferred principal loan.

The multifamily addition would be eligible for an $8.85 million REV Grant.

Money from City Council

The DIA deal is one piece of what could be at least $63.56 million in city cash and tax refunds to revitalize the building shells, which have been vacant for decades.

Atkins has been in talks with Council members Michael Boylan and Matt Carlucci to sponsor legislation or an amendment to the bill that will be filed by DIA to add the $27 million completion grants.

The DIA will not vote on the completion grants or make the final decision on whether the gap funding is feasible for the city.

DIA CEO Lori Boyer said June 15 that the grant request was too high to fit into an existing DIA incentives program based on the project budget.

But DIA officials said the agency had to include it as a source of financing in its analysis because Atkins’ team included it as a funding source in the project construction budget.

Council would have to approve the DIA incentives before they are awarded.

Policy debate

The Trio proposal sparked a broader policy discussion June 15 about what the DIA’s response should be to changing market conditions and higher prices.

Boyer said no location or building Downtown “is more significant” than the Trio, but she said she has concerns about whether the project will be completed because there have been “multiple runs at it.”

Boyer acknowledged SouthEast’s track record with completing The Barnett multifamily renovation project across the street from the Trio.

“Whether this time is the right formula that will get it (Trio) done, I hope so. But I am not confident about that,” Boyer said.

She said she’s heard from other developers that are looking for the DIA and city to “bridge the market gap” on prospective development projects with completion grants for tens of millions of dollars.

“I think that is something that will not be well received at Council or by the new (Mayor-elect Donna Deegan) administration,” Boyer said.

“I just think that is not a consistently affordable approach,” she said. "That’s not where we’re going to be able to go in the next year or two, and things are going to have to right themselves in the market a bit for some of those projects to make sense.”

Board Vice Chair Jim Citrano Jr. was not a voting member on the committee but told the members June 15 he intends to vote against it next week.

Citrano said he supports city completion grants in many cases and thinks economic conditions in the past 12 months have made them necessary for some projects.

Setting a precedent

He fears the deal could set a precedent for developers to expect the city to fund a higher percentage of private projects than current policy allows.

“The issues that Steve (Atkins) is going through in trying to get this budget to work, everybody else is going through the exact same thing, Citrano said.

Citrano is senior vice president and commercial real estate banker for Seacoast Bank’s North Florida Region.

He also questioned whether Atkins can secure what would be more than $100 million in construction loans and bridge financing in the current lending market to meet the deal’s 36-month project completion deadline.

Citrano said the DIA’s role is shoring up financial gaps to make projects work. He said he was hesitant to approve a portion of an incentive package when the numbers show it wouldn’t work without the Council-approved $25 million completion grant.

“That should be funded by equity,” he said.

“What we should not be doing is financing the cost of inflated construction materials, which everybody in the city and in the country is dealing with now in financing higher borrowing costs.”

“If you look at the sources and uses, he qualifies for (nearly) $40 million. That’s a lot of money. I think $60 (million) is a bridge too far, in my opinion.”