A newspaper workers union is calling for Gannett Co. Inc. shareholders to vote the company’s CEO off the board of directors, and it’s using data about The Florida Times-Union and other newspapers in its campaign.

The NewsGuild-Communications Workers of America said in a letter to stockholders that Gannett Chairman and CEO Mike Reed “has failed shareholders” and is urging them to withhold votes for him at the company’s June 5 annual meeting.

The May 16 letter included in a Securities and Exchange Commission filing said Gannett’s stock fell 70% from the time of the GateHouse Media and Gannett merger in November 2019 through May 10, 2023.

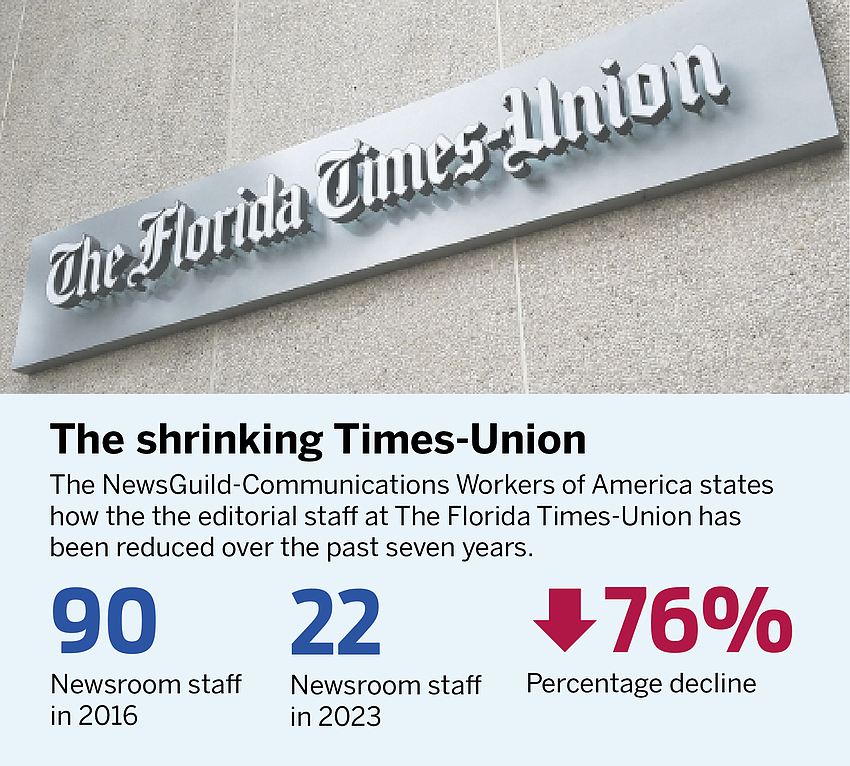

The union also addresses cuts in newsroom operations at Gannett papers in recent years.

As an example, it cites the Times-Union, saying its data shows the Jacksonville newspaper had a newsroom staff of 90 in 2016, which was reduced to 62 two years later and dropped to 22 by April 2023.

The union also said in a fact sheet that The St. Augustine Record now has just one reporter.

Other newspapers owned by Gannett had similar staff cuts, but the Times-Union and Record have only been part of Gannett since its 2019 acquisition of GateHouse.

Morris Publishing Group, parent of both newspapers, was sold in 2017 to New Media Investment Group Inc., which operated its newspapers under the GateHouse brand.

Before Gannett acquired GateHouse, Times-Union newsroom employees voted to unionize, forming the Times-Union Guild as part of the Communications Workers of America.

Besides counting newsroom staff, NewsGuild-CWA members also counted local stories in the Gannett newspapers on three dates over the last 10 years: the last Wednesday of April 2013, 2018 and 2023.

For the Times-Union, they found 41 local stories on that day in 2013, 31 in 2018 and 10 in 2023.

“Mr. Reed has dangerously mortgaged the future of our company by assuming debt with high interest rates and quarterly payments that are extracted from stakeholders,” the union’s letter said.

“He has reduced local content by relying on wire service and regional stories, cut newsroom staff, and maintained a compensation policy that is forcing many of our journalists to seek work elsewhere. As a result, our communities are not being served and our employees are demoralized.”

Reed has been CEO and a board member of Gannett since November 2013. He has been board chairman since May 2019.

The company did not file a response with the SEC to the union’s solicitation of shareholders.

Landstar System Inc. fell to its lowest level since early January after its top executives said second-quarter earnings will be lower than its previous forecast.

CEO James Gattoni and Chief Financial Officer James Todd, speaking May 24 at the Wolfe Research 2023 Global Transportation & Industrials Investment Conference, said second-quarter truckload volume was trending 16% to 18% lower than last year, according to an SEC filing.

As a result, the Jacksonville-based trucking company now expects earnings of $1.75 to $1.85 a share, down from its previous forecast of $1.90 to $2.

Revenue is now expected to be $1.325 billion to $1.375 billion, down from its previous forecast of $1.4 billion to $1.45 billion.

Landstar had second-quarter 2022 earnings of $3.05 a share and revenue of $1.975 billion.

Landstar’s stock fell as much as $5.90 to $169.16 on May 24 after the updated forecast.

Also at the Wolfe conference, CSX Corp. Chief Executive Joe Hinrichs said second-quarter freight trends have been mixed for the Jacksonville-based railroad company.

Hinrichs said the company’s intermodal business is down by a double-digit percentage this year, with particular softness from international shippers, but several categories of merchandise are growing strongly.

He said shipments of automobiles, metals, grains and construction aggregates are up.

“On balance, I think so far this year we’re up about 4% on merchandise, and in a healthy pricing environment. So, we feel good about that part of the franchise,” Hinrichs said.

Trailer Bridge Inc. said May 24 it appointed former Stein Mart Inc. Chief Financial Officer Greg Kleffner as its CFO.

Kleffner was CFO of the Jacksonville-based fashion retailer for more than nine years before retiring in December 2018.

Stein Mart filed for Chapter 11 bankruptcy in July 2020 and went out of business, as it could not recover after the coronavirus pandemic forced it to close stores in the spring of 2020.

Trailer Bridge said in a news release that it is bringing in Kleffner to support its plans to be a billion-dollar company by 2027.

The Jacksonville-based marine freight shipping company previously said its 2021 revenue was $240 million.

Trailer Bridge was publicly traded before a 2011 Chapter 11 bankruptcy filing.

It emerged from bankruptcy in 2012 under the control of Fort Lauderdale-based Seacor Holdings Inc., which continues as a partner in a joint venture that owns Trailer Bridge.

Medtronic plc reported higher-than-expected earnings for its fourth quarter ended April 28, including strong growth from its Jacksonville-based division which makes surgical instruments for ear, nose and throat physicians.

However, the Ireland-based medical products giant’s forecast for fiscal 2024 was below analysts’ expectations.

Medtronic said fourth-quarter revenue rose 5.6% to $8.5 billion and adjusted earnings rose by 5 cents a share to $1.57, a penny higher than the average forecast of analysts surveyed by Zacks Investment Research.

The company said the ENT division grew revenue by a low double-digit percentage, but it does not report more detailed sales data for that business.

Medtronic forecast adjusted earnings of $5 to $5.10 for fiscal 2024, below the Zacks’ consensus forecast of $5.18.

Medtronic’s stock fell as much as $5.18 to $82.31 on May 25 after the report.

The stock was one of the biggest losers among S&P 500 companies for the week, dropping 9%, according to investing website Seeking Alpha.

Shoe Carnival Inc., the footwear chain controlled by former Jacksonville Jaguars owner Wayne Weaver, reported lower sales and earnings for its first quarter ended April 29.

Sales fell 11.4% to $281.2 million and earnings fell by 35 cents a share to 60 cents.

The Evansville, Indiana-based company said inflation, a reduction in federal tax refunds and unfavorable weather affected customer traffic in the quarter.

Shoe Carnival operates 398 stores in 35 states and Puerto Rico under the Shoe Carnival and Shoe Station banners.

IQ Fiber said May 24 it received $150 million in follow-up equity funding from its founding investor, SDC Capital Partners LLC.

The Jacksonville-based company said it will use the additional investment to support further network deployment and customer growth.

IQ Fiber, established in 2021, provides fiber optic network services in Duval, Nassau, St. Johns and Clay counties.

The company employs 75 people and said it is on track to reach its Phase 1 target of 60,000 serviceable homes in the four-county region.