The Downtown Investment Authority will consider new economic incentives and revising existing programs in response to a tightening construction lending market and Mayor Donna Deegan’s push to stimulate small business growth in Jacksonville.

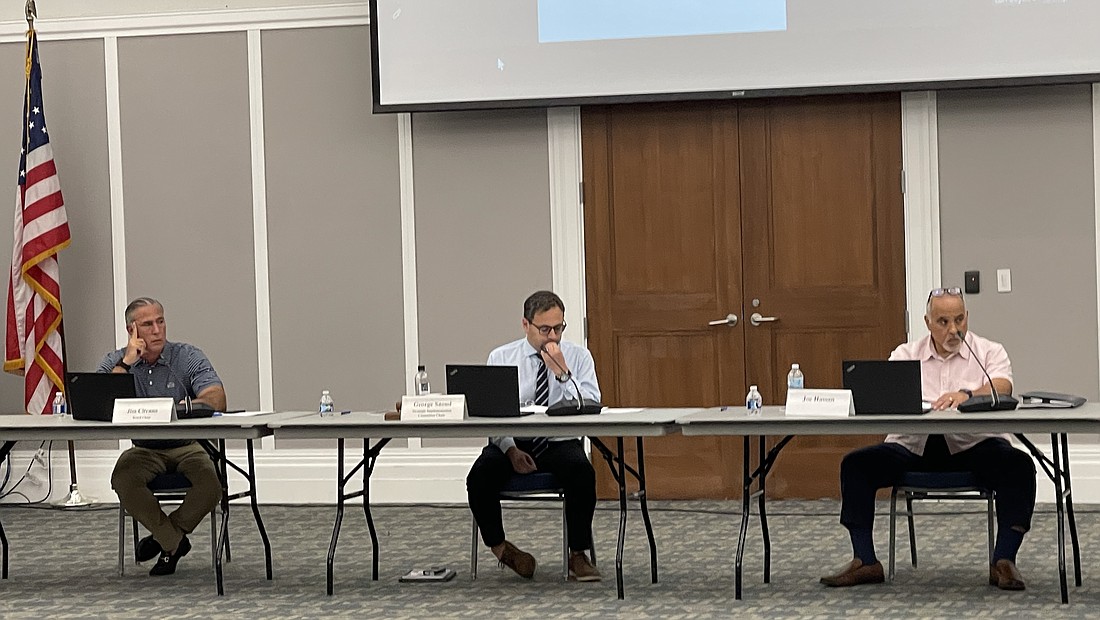

The DIA Strategic Implementation Committee met July 14 and heard the first of what is expected to be a string of proposals from its staff to boost retail, restaurants and other small business activity in the Downtown Northbank and Southbank.

The proposed DIA Compliance Support Program would offer to pay 50% of small business owner costs to bring a building up to city, state or federal codes up to $250,000.

Steve Kelley, the authority‘s director of Downtown Real Estate and Development, said the staff also would bring to the board proposed changes in August to its building facade grant program and the Downtown Preservation and Revitalization Program.

Different conditions

DIA CEO Lori Boyer said July 14 that economic conditions were different when the authority was updating its incentives as part of its five-year Business Investment & Development Strategy update.

“As you know, we are in the midst of a mayoral transition and a (City) Council transition. We are also in challenging market and economic conditions both from construction costs and interest rates and equity returns,” Boyer told the committee.

“All of that is creating a number of challenges that may not have been faced when we were revising our BID strategy back in 2021 and early 2022.”

Boyer said higher interest rates have made borrowing money to pay for construction costs more expensive and banks are approving fewer loans.

During her campaign for mayor and at her July 1 inauguration speech, Deegan emphasized a desire to create “small business ladders” and make Jacksonville “the small business capital of the Southeast.”

According to the DIA, it is looking to reinforce or create programs that can be funded by tax increment money generated by property taxes in the Downtown Northbank and Southbank Community Redevelopment Areas that will not impact the city’s general fund.

Boyer said after the meeting that the effort to provide more incentives to small businesses does not mean the city and DIA will not continue incentives for large private development or projects.

“That is not to say we are leaving large businesses or large developments behind. We are simply saying there’s plenty of work to do,” Boyer told the committee.

Code compliance proposal

The committee did not take action July 14 to advance a resolution that would implement the program, but the members appeared generally supportive and asked DIA staff to add more safeguards for taxpayers.

The draft project outline in the meeting packet says the program could financially support qualifying business owners to meet code compliance requirements brought by government agencies to “improve safety and soundness of properties.”

That includes improvements like elevator upgrades, emergency exiting, fire suppression systems and Americans with Disabilities Act compliance.

Though it is based on the code compliance forgivable loan program in the Downtown Preservation and Revitalization Program for historic buildings, the proposal would include buildings at least 20 years old that have been on the property tax roll for three years.

According to the program description, code compliance cannot be paired with other DIA incentives.

DIA board chair Jim Citrano and member Joe Hassan said they want staff to add language that would keep building owners with chronic city nuisance liens from abusing the program and insert other benchmarks to prove financial need.

“If a building is fully leased and doing well, then modernizing your elevator is part of doing business,” Hassan said.

“It’s a CapEx (capital expenditure) cost you have versus a building that’s 30% occupied and barely hanging on — having trouble covering their debt service.”

The committee could consider the amended plan at its August meeting.