A recent study shows that the state’s drivers are paying some of the highest premiums in the U.S. when they buy automobile insurance.

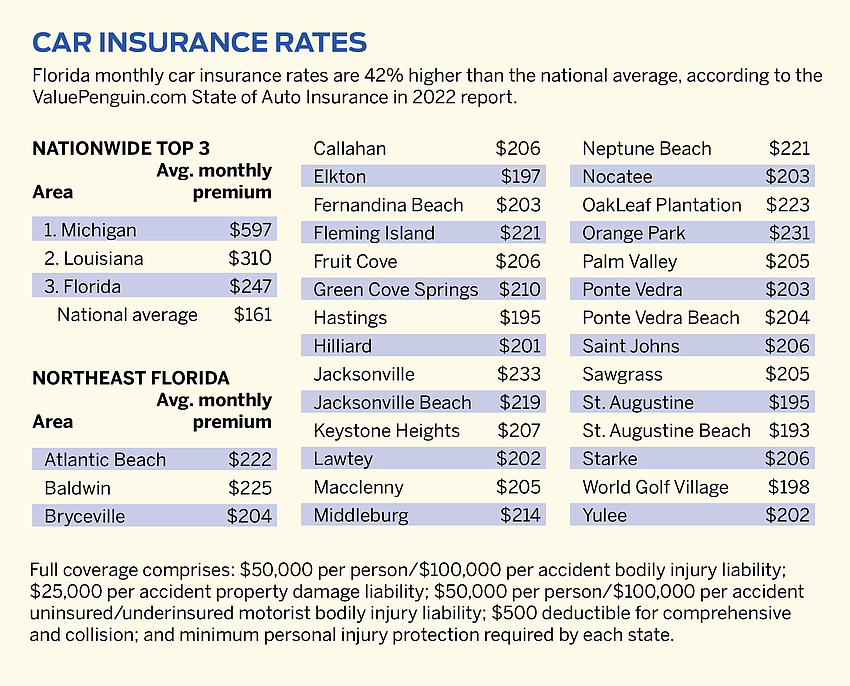

People who insure their vehicles in Florida pay the third-highest premiums in the U.S., based on “State of Auto Insurance in 2022,” a study published in January by ValuePenguin.com.

The survey found that drivers who live in Northeast Florida pay lower than the state average rate for full-coverage auto insurance.

More than 15 million insurance quotes in 35,000 ZIP codes were analyzed for the study.

The rate comparisons are based on insuring a 30-year-old male who drives a 2015 Honda Civic EX and has an average credit history and no prior accidents.

Key findings:

• Driver behavior and history impacts insurance premiums. A traffic violation such as a speeding ticket or accident can increase coverage cost by as much as 55%; a DUI conviction can lead to a premium increase of as much as 90%.

• The study found the difference between a good and poor credit score can change premiums by 48%, as people with poor credit may be more likely to file claims with their insurers, the authors state.

• Another reason auto insurance rates are expected to increase is that more people are returning to work after the pandemic, increasing travel volume and accident claims.

• Technology also is affecting insurance premiums.

Using a cellphone while driving can increase the possibility of distracted driving that could cause property damage or personal injury liability.

There are about 3,000 fatalities each year attributable to distracted driving, the study states.

More vehicles are equipped with expensive gadgets – rearview cameras, for example – that increase the cost of repairs after a collision.

The study suggests ways to reduce the cost of auto insurance, including shopping different carriers to find the lowest rates and dropping coverage for extras like roadside assistance or new car replacement.

Some insurance companies offer lower rates for people who drive less because they work at home and some carriers offer pay-per-mile insurance.

Visit valuepenguin.com/state-of-auto-

insurance-2022 to view the report.

ValuePenguin, part of LendingTree, provides research and analysis on topics that include insurance and credit cards.