As sports merchandising giant Fanatics Inc. expands into new businesses like online gambling, the company founded in the Jacksonville area is also growing its sports collectibles business.

Fanatics is engaged in battle with a trading cards industry leader, Italy-based Panini, which heated up in August with the two companies filing competing lawsuits in U.S. federal courts.

With those lawsuits pending, Fanatics won a major victory outside of court when the NFL Players Association said Aug. 22 it was canceling its trading card deal with Panini in favor of a deal with Fanatics.

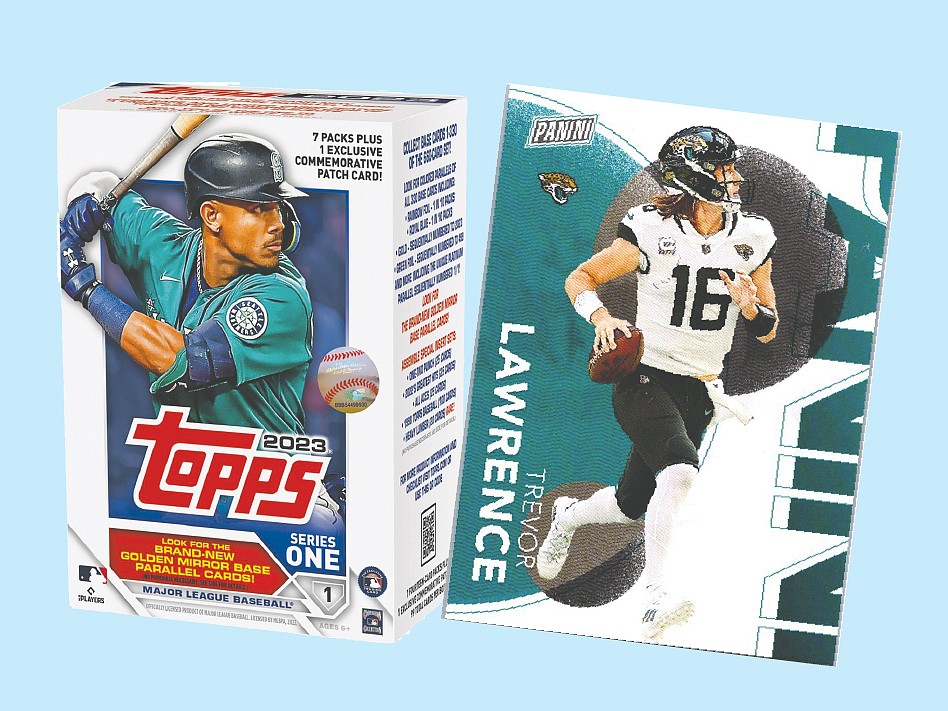

Fanatics has been making licensing deals with sports organizations for several years in the collectibles business and took a big leap into the market with its $500 million acquisition of the trading card business of industry stalwart Topps Co. in 2022.

As Fanatics grows its collectibles business, Panini alleged in a lawsuit filed Aug. 3 in U.S. District Court for the Middle District of Florida in Tampa that the company has engaged in anticompetitive behavior.

Panini built one of the biggest U.S. trading card businesses through its Panini America Inc. unit.

“Since Panini entered the business in 2009, its superior innovation and competitive success have made it a market leader,” Panini America said in the lawsuit.

“Enter Fanatics, which until very recently had zero experience in the trading-card industry. Fanatics is deploying a strategy of calculated, intentional, anticompetitive conduct to monopolize the markets for Major U.S. Professional Sports Leagues trading cards,” it said.

Fanatics responded by filing suit against Panini on Aug. 7 in U.S. District Court for the Southern District of New York.

“This case highlights the stark contrast between two competitors in the sports and entertainment collectibles industry,” Fanatics said in its suit.

“It pits Fanatics Collectibles, the innovative disruptor, against Panini, the stagnant, long-time incumbent,” it said.

Fanatics was founded with a single store in the Orange Park Mall in 1995.

It began growing an online sports merchandising business and founders Mitchell and Alan Trager sold the Jacksonville-based business in 2011 to a Philadelphia company run by current Fanatics CEO Michael Rubin.

The company maintains its commerce headquarters in Jacksonville.

“Over the last two decades, Fanatics has continued to innovate in licensed fan gear. With a world-class organization, the company is best-known for cutting edge e-commerce, as well as designing, manufacturing, and selling officially licensed sports fan gear, jerseys, headwear, and other sports merchandise,” its lawsuit said.

Rubin has expanded the company into other areas since taking control, including collectibles.

“Fanatics Collectibles is revitalizing the sports and entertainment collectibles industry by introducing innovations and quality enhancements that have resonated with athletes, players’ associations, sports leagues, teams, and collectors,” its lawsuit said.

“On the other hand, Panini has become complacent, failing to invest in marketing or innovation as it funnels profits back to its owners in Italy while openly trying to sell its business for nearly a decade,” it said.

Panini said Fanatics’ anticompetitive conduct includes secretly signing deals with major sports leagues and raiding Panini’s employees.

“Unlike Panini — which gradually grew in the United States sports-trading-card industry through innovation and competitive success after starting with shorter term, often nonexclusive deals — Fanatics is preemptively eliminating all competition, before showing competitive superiority or any ability to benefit consumers,” Panini’s lawsuit said.

Fanatics lists division headquarters in several cities, including Jacksonville. Panini said in its suit it filed the action in the Middle District of Florida because of Fanatics’ offices in the district in Jacksonville, Tampa and Lake Mary.

“Fanatics Collectibles has nothing to fear from the baseless litigation that Panini has brought, as Fanatics Collectibles has done nothing other than outcompete Panini by convincing athletes, players’ associations, and leagues that Fanatics Collectibles will maximize the value of their intellectual property in the future,” Fanatics said in the New York filing.

The NFLPA’s decision to move from Panini to Fanatics, which is unrelated to the court cases, is a victory for Fanatics.

Fanatics had a deal to start issuing football trading cards in 2026, according to a story by sports business website Front Office Sports. But the NFLPA’s decision to cancel its relationship with Panini allows Fanatics to begin issuing cards three years early.

Separately, Fanatics unveiled its online sports gambling app Aug. 16.

Fanatics Sportsbook is only available to people in the states of Maryland, Massachusetts, Ohio and Tennessee for now.

Fanatics agreed in June to buy the U.S. sports gambling business of Australia-based PointsBet Holdings Ltd. for $225 million, which will further expand its sportsbook division.

Fanatics’ entire business is valued at more than $30 billion, according to several reports from financial news outlets, and the company is expected to go public at some point.

Evercore ISI analyst David Togut downgraded his rating on Fidelity National Information Services Inc., or FIS, from “outperform” to “in line” Aug. 25.

With the stock trading at $55.26, he also lowered his price target on the stock from $75 to $60, based on a sum-of-the-parts analysis, he said.

“Substantially increasing competition both in U.S. merchant acquiring, specifically in enterprise e-comm, and in Banking Solutions drive our downgrade,” Togut said in his research note.

The downgrade came after FIS announced a change in chief financial officers Aug. 22.

“The recent abrupt CFO transition from 16-year FIS veteran Erik Hoag to incoming CFO James Kehoe concerns us,” Togut said.

“Even though FIS reiterated its 2023 guidance, rapid CFO changes can signal growing risks with the financial outlook.”

Kehoe left a high-level job as chief financial officer of Walgreens Boots Alliance Inc. to join Jacksonville-based FIS.

The parent company of the Walgreens pharmacy chain ranks 27th on the Fortune 500 list of largest U.S. companies with $132.7 billion in fiscal 2022 revenue.

Kehoe had been CFO of Walgreen Boots for five years.

J.P. Morgan Tien-tsin Huang analyst reiterated his “overweight” rating on FIS with a price target of $67 in an Aug. 22 report, before the company announced the CFO change.

“We believe the company is underappreciated for its scale advantages and potential to fully serve super consumers of financial technology across banking, payments and capital markets,” Huang said in an updated report on the payments and processors industry.

“We see share upside from current levels as management provides greater visibility into its medium-term growth expectations and redefines its business model and focus, which we expect to hear more about in upcoming quarters,” he said.

Restaurant Brands International Inc., which acquired Jacksonville-based Firehouse Subs in 2021, has begun seeking international expansion opportunities for the sandwich chain.

In an initiation report on Toronto-based RBI, which also owns the Burger King, Tim Hortons and Popeyes chains, J.P. Morgan analyst John Ivankoe said he expects the company to emphasize international growth for Firehouse.

“The (Firehouse) brand at 1,182 U.S units and 77 international units is relatively small versus various sandwich focused concepts including Subway at 20,576 U.S., Arby’s at 3,415, Jimmy John’s at 2,637, Jersey Mikes Subs at 2,397 and Panera Bread at 2,121,” Ivankoe said in his report.

“It is clear this brand was bought to be able to put into the global scale of the RBI international franchise network to be additive to the longer-term brand portfolio. Subway, for example, has about 16,000 international stores,” he said.

Firehouse is by far the smallest of RBI’s four brands, accounting for 3% of total sales.

Ivankoe initiated coverage of RBI with an “overweight” rating.

“We sense a sea change in this business, especially with the appointment of very widely respected former Dominos CEO Patrick Doyle in addition to numerous other executives,” he said.

The changes included the promotion of Joshua Kobza to CEO in March but Doyle’s appointment as executive chairman in November 2022 was “the most significant headline,” Ivankoe said.

“Patrick joined in and invested about $30 million of his own money in shares – at $60.77 per share – to be held for at least 5 years,” he said.

“To us, the combination of both turnaround and growth executives matched with operational and ROI focused financial executives is a strong evolution from the previous approach this Company seemed based on.”

A day after Ivankoe’s Aug. 21 report, Northcoast Research analyst Jim Sanderson raised his rating on RBI from “neutral” to “buy.”

“Deteriorating performance across legacy brands in mature markets had been a key challenge that kept us cautious. But improved performance metrics at Burger King U.S. and Tim Hortons Canada, aided by a sizable war chest to recover lost market share at Burger King U.S., should sustain performance improvements going forward,” Sanderson said in his research note.

Medtronic plc reported big sales gains from its Jacksonville-based division, which makes surgical instruments for ear, nose and throat physicians.

The global medical device company doesn’t report specific sales data for the ENT business but said that unit grew sales by a high-teens percentage in its first quarter ended July 28.

Medtronic, in its Aug. 22 report, attributed the gains to supply improvement.

The Dublin, Ireland-based company said total sales in the first quarter grew 6% (adjusted for foreign exchange rates) to $7.7 billion, with adjusted earnings increasing by 7 cents to $1.20 a share.

Medtronic slightly raised its earnings forecast for fiscal 2024 from $5 to $5.10 a share to $5.08 to $5.16. The company had adjusted earnings of $5.29 a share in fiscal 2023.