TALLAHASSEE — An initial analysis indicates insured losses from Hurricane Ian could range from $25 billion to $40 billion, putting additional pressure on Florida’s troubled property-insurance market.

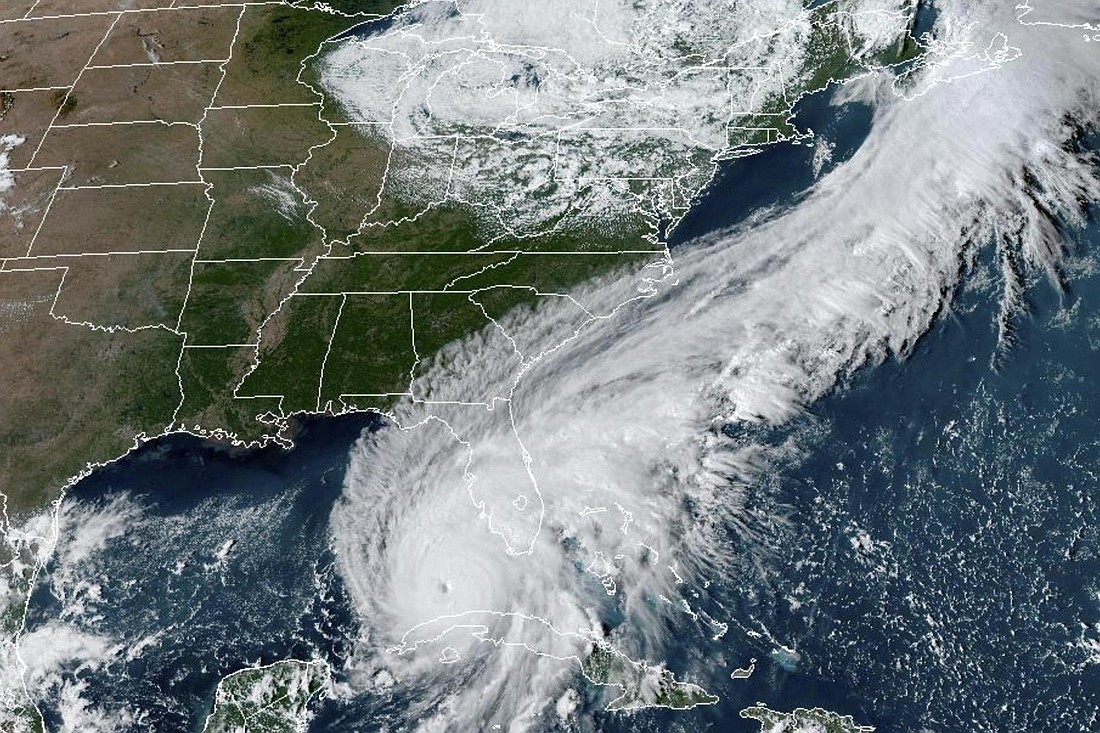

Fitch Ratings released the estimate Sept. 29, a day after the Category 4 hurricane slammed into Southwest Florida and then barreled across Central Florida before exiting over the Atlantic Ocean.

Fitch said many large national insurers do not have “substantial market share” in Florida. But it pointed to potential problems for smaller insurers that focus on providing property insurance in Florida and rely heavily on purchasing reinsurance, which is essentially backup coverage.

“Many insurers providing property coverage in the state experienced severe downturns in underwriting performance and capitalization levels in recent years despite no hurricane hitting the state since 2018,” Fitch said on its website. “This trend has forced a number of smaller insurers into liquidation, exacerbating the challenges for policyholders of finding private market homeowners insurance coverage. The hurricane is expected to worsen the reinsurance capacity crisis for insurers, potentially causing the exit of more Florida specialist companies.”

With private insurers shedding policies to reduce financial risks, the state-backed Citizens Property Insurance Corp. has seen its number of customers more than double during the past two years. Citizens, created as an insurer of last resort, is approaching 1.1 million policies.

Fitch said Citizens appears to have the wherewithal to handle claims from Hurricane Ian but warned about longer-term financial effects.

“Despite having the capacity to absorb losses from this event, strain on Citizens and its continued growth adds to the vulnerability of the insurance market to the next catastrophic event,” the ratings agency said.

Gov. Ron DeSantis called a special legislative session in May to try to shore up the property-insurance system. Lawmakers, in part, agreed to spend $2 billion to provide what is known as a “layer” of reinsurance to property insurers.

The $2 billion added to reinsurance that carriers bought from reinsurance companies and from the Florida Hurricane Catastrophe Fund, a state-run program.

A commentary released Sept. 27 by the AM Best financial-ratings agency said Hurricane Ian would be the “first test” for the $2 billion in reinsurance. But like Fitch, the AM Best commentary pointed to the hurricane potentially affecting the broader reinsurance market.

“Property insurance in Florida is already a tough market, and this impending hurricane looks to make conditions only more demanding,” Christopher Graham, a senior industry analyst for AM Best, said in a prepared statement Tuesday. “Reinsurance rates are already increasing, and a catastrophic hurricane will likely put more pressure on reinsurers to raise rates.”

DeSantis has repeatedly said that large amounts of the damage from Ian would involve flooding and storm surge. Many homeowners buy flood insurance from the National Flood Insurance Program, rather than through private insurers.

Fitch said Florida has the most National Flood Insurance Program policies in the country. It said lenders require flood insurance if homeowners have federally backed mortgages and live in high-risk flood zones as designated by the Federal Emergency Management Agency. But many other homeowners do not buy flood insurance.

State Insurance Commissioner David Altmaier on Sept. 28 issued an emergency order that will temporarily prevent property insurers from dropping customers in the aftermath of the hurricane. The order suspended cancellations or non-renewals of policies for two months.