When it comes to investing in rental properties, location is essential. Choosing the wrong area can mean putting your investment plan at risk. So if you want to know which neighborhoods are best to invest in, especially in the Jacksonville Area, look no further.

How To find the best neighborhoods

We’ll start with our #1 fact for you: The best neighborhood for rental properties is affordable to a larger audience. Rental demand tends to be lower in higher-priced neighborhoods and rental vacancy is one of your biggest ROI detractors as an investor, which is why we focus on long-term leases. With JWB properties, the average resident actually stays for 4.5 years.

So how do we focus on affordability with our properties?

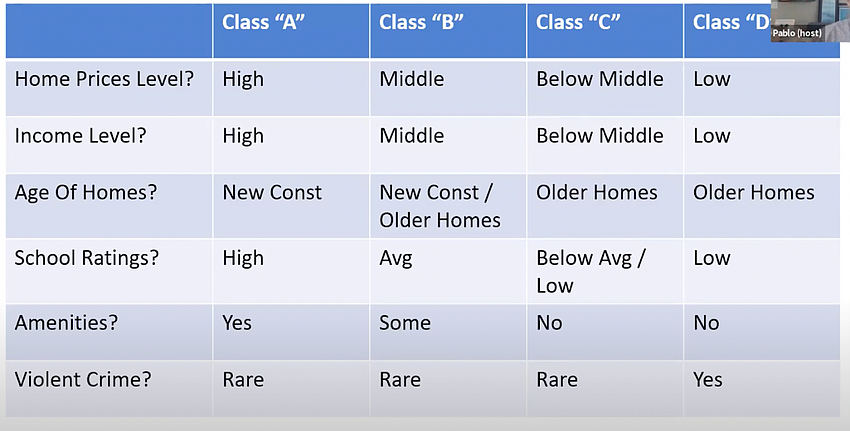

Well, when we look at any property, we can see that there are specific criteria that make the property appealing to a wider audience. Properties are often graded as A, B, C, or D, but we understand that those grades are highly dependent and subjective. So we like to focus on more specific and clearly definable data. Examples of these categories are things such as property values, income levels, age of construction, available amenities, and crime in the area to name a few.

For the sake of categories, we’ve used property class grades, but try focusing on the leftmost column. Which of these classes of properties would be the best to invest in? Take a look at the chart below and make your prediction.

If you’re new to JWB and investing in Jacksonville, it might surprise you that Class “C” properties demonstrate the best class to purchase investment properties in. And there are a few reasons for this.

#1 The property lives just under the middle-income level

Lower to middle-income neighborhoods tend to provide the most balanced returns on investments by providing stable rent prices in relation to home values. These homes are designed for long-term growth, our recommended buy and hold strategy where you hold the property through at least a full market cycle.

Upper-middle income neighborhoods can pose a greater risk, as rents may not keep up with rapidly rising property values, resulting in negative cash flow. Though lower-income neighborhoods may offer initially lower costs compared to other areas, they come with their own risks such as unstable rental rates and property values.

Ultimately, when investing in rental properties it's essential to find a balance between desired returns on investments and associated risks. There’s no perfect investment, but there’s a lot of evidence-backed research to help you make those decisions with JWB.

#2 The property is surrounded by a burgeoning job market

When looking for the best rental property neighborhoods, it's important to consider the local job market. Look for areas with a variety of employers and multiple job options within reasonable commute times (such as 10-20 minutes). This helps ensure that potential tenants are more likely to be able to pay their rent on time, as well as indicate a higher probability of them staying in the area for longer periods of time.

To evaluate the local job market, take a look at the local business journal or contact your local Chamber of Commerce to find out which businesses are coming into the community, who is established in the area, or any Fortune 500 companies nearby.

Jacksonville has been investing in its downtown revitalization project verifying it as a prime location for rental properties as well as having a stable economy.

#3 The property has low crime in the area

When investing in rental properties, it's important to evaluate the safety of a neighborhood. Utilizing sites such as trulia.com, you can access crime maps to determine what areas have higher crime rates and those which may be safer for potential tenants. Though there is no perfect neighborhood when it comes to investments, it's best to steer clear of those with high levels of crime so that your tenants feel secure in their homes.

The Best Neighborhoods to Invest in in Jacksonville

So now you know what makes a neighborhood the “best” for real estate investing, and you’re sure to want to know where to start, so you don’t have to do all of the research yourself. Well, look no further. We personally invest in these four core neighborhoods:

The Core Neighborhoods that JWB invests in:

House appreciation in Jacksonville has outperformed other areas of the state, making this great news for those looking to invest in rental properties, especially with JWB.

At JWB, we advise clients to put their money into these neighborhoods over a full market cycle, to enjoy their fullest ROI potential. Schedule a call with the team and let’s chat!

I love to talk about investing in rental properties! You’ll often find me hosting the weekly Not Your Average Investor Show, contributing to the JWB Real Estate Capital blog, and in our Facebook group connecting with the community & sharing insights.