The weekend before Jacksonville Mayor Lenny Curry’s March 13 state of emergency because of COVID-19, administration officials knew the order would lead to decisions that could flatten the curve but hurt the local economy.

“Based on the early impacts that we knew were coming and had begun, it was clear that particularly small business service industry people were going to be taking at least the first substantial wave of the economic hit,” said city Chief Administrative Officer Brian Hughes during a telephone interview April 8.

Behind the scenes, Curry’s staff started looking at local stimulus options, although Hughes said they expected federal small business and individual assistance to come.

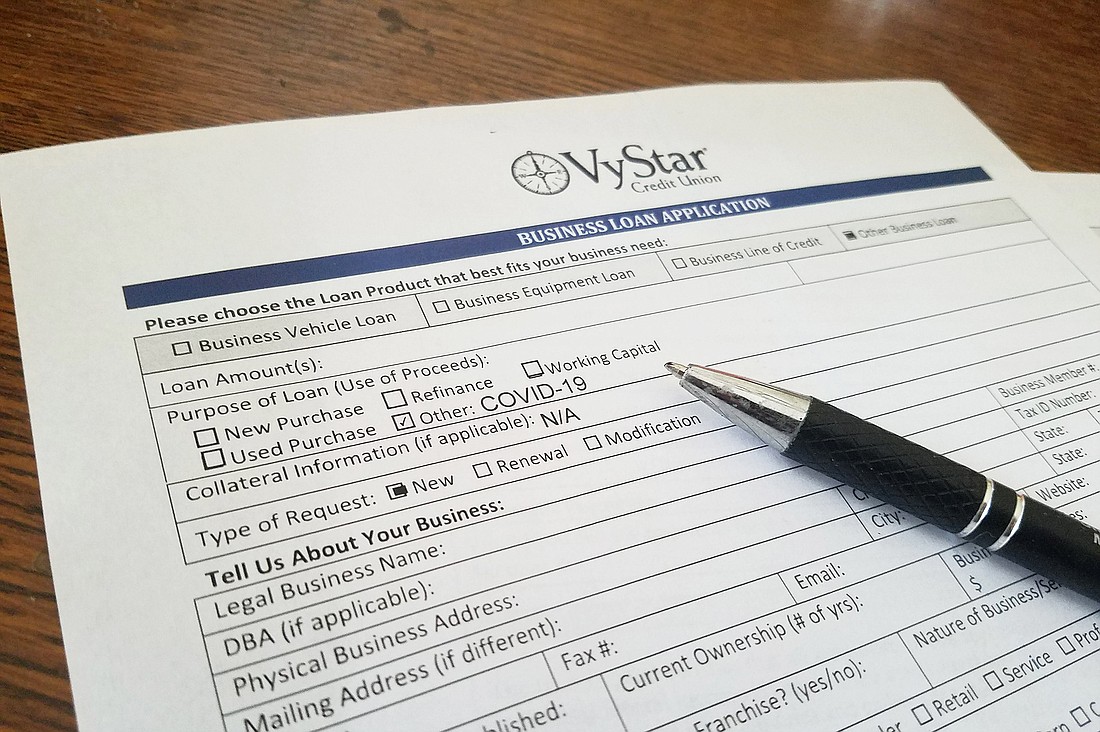

Before city officials started negotiating with VyStar Credit Union on a small business coronavirus relief loan program, Hughes said officials ruled out direct payments to Duval County workers and businesses.

Unlike the federal government, Hughes said the city did not have the infrastructure to get cash to people quickly.

VyStar already had instituted a relief loan program before city CFO Patrick “Joey” Grieve and credit union Chief Lending Officer Jenny Vipperman began working on the public-private partnership.

“We looked for anything we can do to keep the businesses afloat and potentially incentivize borrowing to keep people on payroll until we have a better sense of how long this thing is going to go,” Hughes said.

Hughes said it took a week to get the program from concept to ready to roll out.

“In that week, we told the mayor we were going to get to something,” Hughes said. “(Curry) started talking in his press events trying to expedite some sort of assistance for people or small businesses at least.”

A $50 million loan pool

VyStar has made a $50 million loan pool available for small businesses in the credit union’s COVID-19 Small Business Relief Loan Program.

Businesses can apply for loans up to $100,000 at a 5.99% interest rate. The loan acts as a line of credit, and businesses will get an immediate $1,000 grant from the city, if approved for the loan.

Curry signed Ordinance 2020-0201 into law April 7, allocating $9 million from the city’s general fund for the first year of the COVID-19 Small Business Relief Employee Retention Grant Program.

City officials will budget for a $26 million, six-year grant program.

Hughes said the amount was what VyStar and the city felt comfortable to invest in a higher risk pool.

VyStar CEO Brian Wolfburg told the Daily Record on April 1 the city backing gave VyStar the financial security to allow more lenient underwriting criteria for the loans, allowing for more risk to help more businesses.

Hughes said that although the deal doesn’t have the strong clawback provisions in a typical incentive agreement with the city Office of Economic Development, it’s worth the risk.

“I guarantee you that neither entity is hoping that we don’t get returns and get back as much value as we can,” Hughes said. “But given the circumstances, I think both entities have made the risk analysis that this is the amount of cash we’re prepared to put into a much higher risk environment. Because the potential impact and reward is so high as well.”

The city weighed the risk of loss against continued drops in sales tax, bed tax and other revenue into the future. Hughes said the city has instituted a temporary hiring freeze and changed compensation of nonunion employees to cut costs.

Based on those changes, Hughes said the city should be able to avoid job and other cuts for the remainder of the 2019-20 fiscal year.

He said the small business relief program is advantageous for city coffers because it will help small businesses keep employees on the payroll for the next six months to one year and will make an economic recovery more rapid. It also could potentially reduce the need for Duval County residents to file for unemployment benefits.

“If half of the businesses that get these bridge loans were kept afloat, the long-term economic impact of that business and all those employees being able to ride this out is huge,” Hughes said. “But the risk in that small pool of cash is just as high and problematic.”

Not a “one-and-done” plan

Hughes said the city is not looking at the stimulus as a “one-and-done” effort.

He said the city has enough in its reserve fund to consider a moratorium or reduction on some city fees.

According to the City Council Auditor’s Office, the city had $146.4 million in its reserve fund that could be made available by Council approval.

Hughes did not provide details on what fees could be waived.

Commercial businesses that rent city-owned space also could see some relief in charges, Hughes said.

“We’re looking at things all across government,” Hughes said. “There’s a variety of ways we have at our disposal to try and incentivize businesses that are struggling and find ways to keep the economy going that in the long term will provide benefit to taxpayers if we help mitigate.”

Loan program qualifications:

To qualify, businesses must report their employment levels as of Feb. 29. A business must be in Duval County and have:

• Completed one year of operation.

• Completed at least one tax return.

• Have between two and 100 employees.

Loan program guidelines:

• Businesses can apply for loans up to $100,000 at a 5.99% interest rate. The loan acts as a line of credit, and businesses will get an immediate $1,000 grant from the city, if approved for the loan.

• VyStar will waive the $250 loan underwriting fee for loans under $5,000. The city will pay the fee for loans above $5,000.

• The city will cover 100% of the loan interest payments in the first year. No principal payments will be due during that time.

• In years two through six, the city will provide grants to cover interest costs, if businesses retain at least 50% of their precoronavirus workforce. Business owners could get up to 50% of the principal reimbursed — 10% annually — after the first year. This is in the form of a grant by the city.

The application process

• Go to VyStarcu.org/coronavirus and click on “More on Business Relief.”

• Download and complete the loan application.

• Email the completed application with all business owners signed as guarantors and the following financial documentation to [email protected]:

• 2019 tax returns, if filed.

• In lieu of 2019 returns, submit 2018 tax return and 2019 year-end profit and loss statement and balance sheet.

• If no tax returns have been filed, provide 2019 year-end profit and loss statement and balance sheet.

• The most recent personal tax return filed by all business owners.

Loan processing

• A VyStar representative will acknowledge receipt of the completed application and start processing the request.

• VyStar’s decision will be received by the applicant within three business days.

• If the application is approved, VyStar will send closing documents via email through DocuSign within one business day from approval.

Getting the money

After loan documents are signed, the loan will be booked and the first advance will be available in the applicant’s VyStar business deposit account.

• Funds will be available within one business day from the date the loan documents are completed.

• Additional advances can be requested through the Contact Center or a VyStar Branch.

• Advances will be deposited only into the business’s deposit account.