Although Aetna Inc. agreed to buy Humana Inc. for $37 billion last summer, both companies independently moved forward with plans to relocate their Jacksonville offices away from Downtown to suburban offices on the Southside.

It’s probably a good thing the companies didn’t wait on completion of the merger to make those decisions because according to a couple of reports last week, there are still antitrust concerns that could derail the deal.

Bloomberg News reported that, based on the track record of the U.S. Justice Department under the Obama administration, the Aetna-Humana deal may have a tough time getting federal approval.

Aetna’s proposed acquisition of Humana coincides with another health insurer deal in which Anthem Inc. agreed to buy Cigna Corp. That would reduce the number of major national health insurance companies to three: Aetna, Anthem and UnitedHealth Group Inc.

Analysts are debating if the Justice Department will let that happen, given that it has been unkind to mergers that potentially reduce competition.

The Aetna-Humana deal took another hit last week when the Missouri Department of Insurance ruled the merger would lessen competition in “a few specified lines of insurance” in the state.

That ruling is very unlikely to stop the merger but it again raised attention about the antitrust issues.

The Florida Office of Insurance Regulation approved the deal in February and Aetna said at the time that it had received 10 of 20 required state approvals for the deal.

With the deal still a long way from completion, Aetna and Humana have not said how the merger would affect Jacksonville operations.

However, Aetna last week announced it will relocate its Jacksonville office from the 22-story Aetna Building on the Southbank at 841 Prudential Drive to a new office at 9000 Southside Blvd. in the Gramercy Woods office park near The Avenues mall.

Aetna has about 800 employees but said the Southside site was chosen “with potential employment growth in mind.”

Before the merger was announced in July 2015, Humana had already made plans to move 100 employees out of Downtown Jacksonville to two Southside locations, Prominence Plaza in Baymeadows and Merchants Walk in Mandarin. The merger agreement did not stop that process.

Aetna has said it hopes to complete the acquisition in the second half of this year.

Analysts see CSX opportunities

Stifel Nicolaus analysts reiterated their “buy” rating on Jacksonville-based CSX Corp. after a day of investor meetings with Chief Financial Officer Frank Lonegro and Vice President and Treasurer David Baggs.

In their report after the meeting, the analysts said a big part of the industry’s story is the continued shift away from coal shipments. However, they see opportunities for CSX to profit from its intermodal business.

“Intermodal trains provide the possibility of backhaul revenue –– in other words you can move volumes back and forth to/from New York and Chicago, which is usually not the case in and out of a coal mine,” they said.

The analysts said CSX’s intermodal business can compete well with trucking companies.

“Within the context of highly constrained trucking capacity and industry margin compression led by lower pricing, trucking companies could be incentivized to put volumes on the rails, if they can get comfortable with the relationship. If not, CSX can compete directly for business through their intermodal/logistics point to point service.”

Moody’s downgrades Deutsche Bank

While Deutsche Bank is growing its Jacksonville operations on the Southside, the Germany-based bank’s global operations continue under scrutiny.

Moody’s Investors Service last week downgraded its rating on Deutsche Bank’s senior unsecured debt from Baa1 to Baa2, a level that is just two notches above junk bond status (which is Ba or lower).

The credit rating agency cited risks to the company’s five-year restructuring plan.

“Deutsche Bank’s new management team is executing in a disciplined way, but the headwinds have stiffened, reducing the firm’s operating flexibility,” Moody’s Senior Vice President Peter Nerby said in a news release.

The headwinds include continued low interest rates and economic uncertainty, the firm said.

“These forces will likely result in periods of subdued customer volumes and revenues within Deutsche Bank’s retail, asset management and institutional franchises, in Moody’s view,” it said.

“Moody’s expects that such revenue weakness could hinder or delay Deutsche Bank’s ability to make progress on its plan, as this would be contingent on the firm’s ability to balance the impact of plan-related expenses on its internal capital generation against the firm’s growing regulatory capital requirements.”

Moody’s did say the ratings outlook for the company is stable.

“Deutsche Bank maintains a sound liquidity position which is supportive of the bank’s credit fundamentals while management is deploying many operating and financial tools to execute this multi-faceted re-engineering,” it said.

The downgrade came a few days after Deutsche Bank management faced what Reuters news service described as “angry” shareholders at the company’s annual meeting.

The company’s stock price has dropped by about 50 percent in the last 10 months after Deutsche Bank reported a net loss of $7.9 billion last year, raising the ire of investors.

Deutsche Bank did report net income of about $268 million in the first quarter this year.

Shoe Carnival earnings below forecasts

Shoe Carnival Inc. reported what it said were record first-quarter sales and earnings. However, the results were slightly below analysts’ forecasts, sending its stock to its lowest level since January.

The footwear chain controlled by former Jacksonville Jaguars owner Wayne Weaver said total sales rose 3 percent to $260.5 million in the first quarter ended April 30, but the average forecast of analysts was about $263.5 million, according to Thomson Financial.

Comparable-store sales (sales at stores open for more than one year) rose 2.7 percent.

Shoe Carnival’s earnings per share rose by 4 cents to 56 cents, but that was a penny below the average analysts’ forecast.

Shoe Carnival’s stock fell $2.12 to $21.27 on May 20 after the earnings report.

In a news release, CEO Cliff Sifford said results were helped by strength in athletic footwear and expense control.

“As we enter the second quarter, we expect to further benefit from our assortment of sandalized footwear as warmer weather arrives in addition to the continued strength in athletic footwear.” Sifford said.

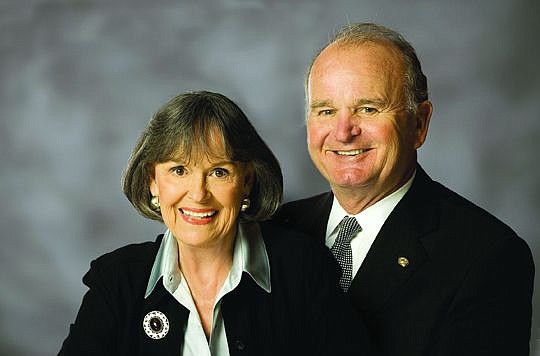

Weaver is chairman of Shoe Carnival and its largest shareholder, controlling 25.2 percent of the stock along with his wife, Delores.

Shoe Carnival, which operates 404 stores across the country, is projecting earnings to grow by 9 percent to 14 percent in the full fiscal year to a range of $1.58 to $1.65 a share.

Foley’s blank check company completes IPO

Bill Foley’s new “blank check” acquisition company, CF Corp., completed its initial public offering less than a month after filing its initial plans, raising $600 million.

Foley, chairman of Jacksonville-based Fidelity National Financial Inc., formed the company with former Blackstone Group dealmaker Chinh Chu.

They are building a war chest to go after a significant acquisition, although they haven’t given any indication of what type of business it may be.

Foley has been involved in several business ventures outside of Fidelity. CF Corp. has no connection to Fidelity.

CF sold 60 million units at $10 each. Each unit consists of a share of stock plus one-half of one warrant that would entitle holders to purchase another share of stock for $11.50.

According to a prospectus filed with the Securities and Exchange Commission, if CF cannot complete an acquisition within 24 months, it will redeem all of the public shares for cash.

The units are trading on the Nasdaq Capital Market under the ticker symbol “CFCOU.” The stock and warrants are not yet trading individually but the stock is expected to trade under the ticker “CFCO” and the warrants should trade under “CFCOW” by July.

CF’s headquarters office is in Las Vegas. Foley is also the lead partner of a group that is trying to secure a National Hockey League expansion team in Las Vegas, but there is no indication that CF has any connection to that group.

A decision by the NHL on expansion is expected next month.