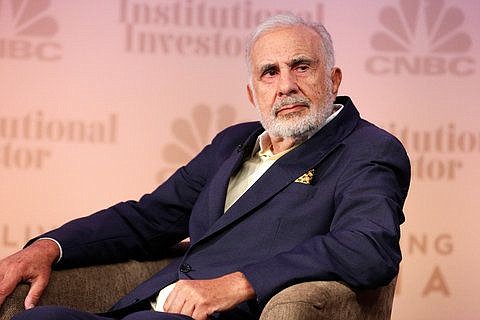

As if Gannett Co. Inc. didn’t already have its hands full dealing with plans to split its broadcasting and publishing businesses into separate companies, now it’s facing a proxy fight with activist investor Carl Icahn.

The billionaire, who controls 6.63 percent of Gannett’s stock, is nominating two directors of his own to the company’s board and asking shareholders to approve proposals that would make it easier for someone to take over the company — apparently either company after the split.

It’s all very confusing for Icahn to bring these proposals now as Gannett is preparing to split up.

“We are surprised by Mr. Icahn’s aggressive actions, including his threat to run a proxy contest to force wholesale changes in Gannett’s corporate governance and dictate the corporate governance of a company whose governance profile has yet to be determined,” Gannett’s board chairman, Marge Magner, said in a news release Thursday.

Gannett announced plans in August to spin off its publishing division, which includes USA Today and 81 daily U.S. newspapers, as a separate company.

The other company would be a broadcasting and digital business that operates Gannett’s 46 television stations, including WTLV TV-12 and WJXX TV-25 in Jacksonville.

Icahn said in a letter to Gannett CEO Gracia Martore that he supports the spinoff plan, but he doesn’t see it as a final step.

“After Gannett completes the spin-off, both the publishing company and the broadcasting and digital company will be comprised of extremely valuable assets, and, as others in their industries look to consolidate, I would not be surprised if either company became the target of a takeover attempt,” the letter said.

“If this occurs, the shareholders — the true owners of the company — should have the full and only right to decide whether or not to accept the offer,” it said.

Martore said in the company’s news release that shareholders should be pleased with the current direction of the business.

“Since the launch of our strategic transformation plan three years ago, we have achieved significant revenue growth and margin expansion. During that same period, we have made attractive acquisitions to execute on our announced strategy, our stock price has more than doubled and total shareholder return has exceeded 265 percent, outpacing the S&P 500 and our peers by a wide margin,” she said.

Gannett has been planning to complete the spinoff by the middle of this year. Apparently, it would happen after its spring annual shareholders meeting, when stockholders would have the opportunity to vote on Icahn’s proposals.

This will all make Gannett a very interesting company to watch this year.

Schapiro says activists have a role

A couple of days before Icahn launched his proxy fight with Gannett, former Securities and Exchange Commission Chairman Mary Schapiro told a Jacksonville audience that public companies can’t ignore activist shareholders.

“Sometimes activists will have good ideas and they’re worth listening to,” Schapiro said in response to a question about activism at a World Affairs Council of Jacksonville luncheon Tuesday.

Schapiro has first-hand experience as a board member of Kraft Foods, when investor Nelson Peltz pushed for changes. She said his push eventually led the company to split into two public companies in 2012: Kraft Foods Group Inc. and Mondelez International Inc.

“I think the jury’s still out on whether that was a good move,” said Schapiro, who left Kraft’s board before she became SEC chairman in 2009.

However, Schapiro said corporate boards have “a fiduciary duty” to listen to proposals from any shareholder.

Vistakon sales fall again

Johnson & Johnson last week reported sales in its vision care division, Jacksonville-based Vistakon, dropped 10.2 percent to $646 million in the fourth quarter.

That was partially due to currency fluctuations affecting international sales, but U.S. sales for the contact lens company dropped 14.5 percent.

For all of 2014, Vistakon sales fell 4.1 percent to $2.8 billion. Excluding currency impacts, sales fell 1 percent on an operational basis.

Johnson & Johnson has said that pricing issues have been impacting Vistakon’s sales.

“Competitive pricing dynamics negatively impacted growth for vision care in the U.S. This was partially offset by growth outside the U.S with strong results in emerging markets,” Vice President of Investor Relations Louise Mehrotra said in the company’s conference call with analysts Tuesday.

Johnson & Johnson CEO Alex Gorsky said in the conference call that the company is looking beyond contact lenses to grow sales in its vision care division, such as research on stem cell therapy to treat macular degeneration.

“We think it offers a great complement to our existing vision care platform,” he said.

“As technologies are advancing, we’re seeing more and more opportunities for cross-segment collaborations, bringing together the scientific, regulatory, clinical and commercial expertise from across Johnson & Johnson to improve care,” Gorsky said.

Johnson & Johnson brought in a new president for Vistakon’s North American division, Laura Angelini, in September 2013.

“Our vision care business is facing challenges in the marketplace, but they’ve done a lot of good changes recently and we think they are well-positioned for the future,” said Gorsky, without specifying those changes.

Falling gas prices benefit JTA

If you think about it — not that many people would — the continuing free fall in gasoline prices might seem like a bad thing for the Jacksonville Transportation Authority’s revenue. Theoretically, cheap gas entices more people to drive cars, as opposed to taking public transportation.

However, a report from Fitch Ratings on a new JTA bond issue points out that more driving by Jacksonville residents will benefit the transportation agency, because of the Local Option Gas Tax (LOGT).

“LOGT revenues have not performed particularly well in recent years, reflecting the pace of economic recovery, a prolonged period of high gas prices and the increased number of fuel-efficient vehicles in use,” Fitch said in its report.

“Fiscal 2014 LOGT revenues remain more than 11 percent below their prerecession peak, and revenue declines have been recorded in six of the prior eight years. Declining gas prices could boost consumption and revenue collection in the near term,” it said.

Duval County gas stations charge a 6-cent tax on every gallon of motor fuel sold, with 5 cents of that going to JTA. It doesn’t matter what the price of gas is — the tax remains constant at 6 cents a gallon. So, anything that increases gasoline consumption means more revenue for

JTA.

Fitch said the gax tax revenue in the fiscal year ended Sept. 30 did show modest 0.6 percent growth, as drivers started to see lower prices.

The Fitch report analyzed a $100 million JTA bond offering two weeks ago that will be paid off by the gas tax. Fitch rated the bonds at AA-minus.

Wolfe Research downgrades Landstar

After a strong 26 percent increase last year, Landstar System Inc.’s stock dropped about 10 percent in the first two weeks of 2015, and one analyst thinks it may drop further.

“Landstar reported strong volumes and pricing last year, but we expect slower revenue and EPS growth this year into much tougher comparisons,” Wolfe Research analyst Scott Group said in a report last week.

“Landstar has already started to underperform this year, and we expect it will continue to lag other transports this year, so we’re reducing our rating from ‘peer perform’ to ‘underperform,’“ he said.

Group said shrinking profit margins will make it difficult to increase earnings.

“If revenue growth slows this year, we think it will be tough to grow EPS much more than 10 percent. Our $3.35 estimate assumes 11 percent EPS growth and is 3 percent below prior consensus,” he said.

Lower gas prices won’t have any impact on the Jacksonville-based trucking company because it passes fuel costs off to customers, he said.

Group was the second analyst this month to downgrade Landstar before it reports fourth-quarter earnings. KeyBanc Capital Markets analyst Todd Fowler downgraded the stock from “buy” to “hold.”

Landstar is scheduled to report its yearend results on Thursday.

Analyst upgrades CSX

Some analysts were lukewarm about CSX Corp. after the Jacksonville-based railroad company’s earnings report two weeks ago, but Susquehanna Financial Group analyst Bascome Majors upgraded his rating on CSX from “neutral” to “positive.”

Majors’ upgrade was part of a general look at railroad stocks, which happened to come after CSX’s earnings report but before the other major railroads issued their yearend reports.

“Rail stocks have started off 2015 with a whimper, which we view as a buying opportunity given signals of still strong demand, expectations of accelerating pricing, layup first-quarter comparisons (with falling fuel poised to help further), and fears toward coal and shale-related revenues we see as overdone in the near-term,” Majors said in his report.

He said after “a very solid report and outlook from CSX” that “mid-term risk/reward now skews favorable.”

Majors said CSX’s favorable outlook is in part a result of merger talk last fall. CSX in October rejected possible merger overtures from Canadian Pacific Railway Ltd.

“Rising pressure to deliver consistent double-digit EPS growth after news of CP’s M&A interest in October was followed by more aggressive cost cutting actions announced in November that should pad 2015’s bottom line,” Majors said.

Under the program announced in November, 298 CSX employees accepted buyouts, and CEO Michael Ward said the company may lay off a “minimal” number of additional workers at its Jacksonville headquarters as it reorganizes operations after the buyouts.

(904) 356-2466