Note: This story has been updated with the number of residential units.

Jacksonville Jaguars owner Shad Khan’s proposed $2.5 billion Lot J and Jacksonville Shipyards development is a starting point for two decades of development in Downtown’s Sports and Entertainment District, said The Cordish Companies Chief Operating Officer Zed Smith.

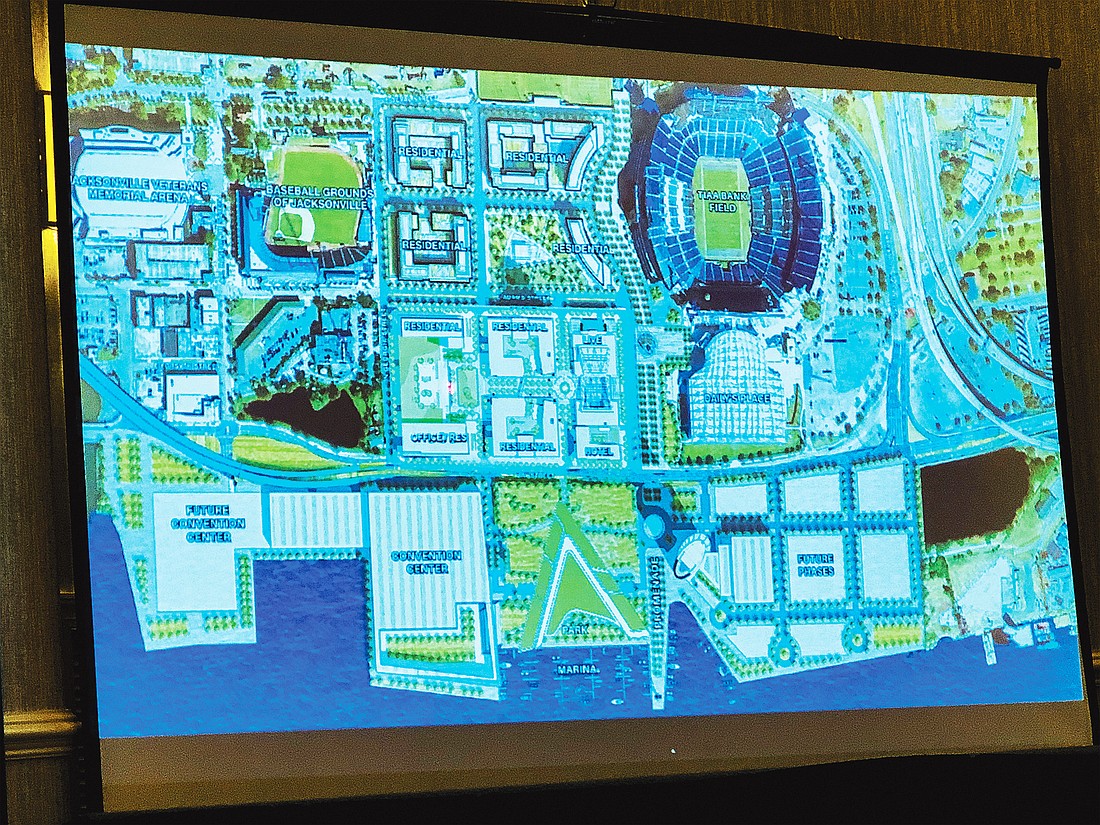

Smith showed updated renderings of the first two phases of development of Lot J near TIAA Bank Field, the Shipyards and a previously unannounced residential expansion north of Lot J in a presentation March 2 to the Meninak Club of Jacksonville.

“The thing that appealed to us about Jacksonville is we have the land to develop into the future. We could be building here for the next 20 years,” Smith said of The Cordish Companies and Khan’s subsidiary.

Baltimore, Maryland-based Cordish and Jaguars’ subsidiary Gecko Investments LLC are equal partners in the Lot J-Shipyards project, operating as Jacksonville I-C Parcel One Holding Company LLC, according to the Lot J development term sheet released by the city July 31.

The $450 million to $500 million Phase I of Lot J comprises the Live! Arena entertainment venue, a 200-unit boutique hotel and 700 residential units. Smith said the development would include 400 mid-rise units and 300 high-rise units.

Phase II is west of Lot J at what is a retention pond at North Georgia Street and Gator Bowl Boulevard.

The renderings appear to shift Lot J’s proposed Class A office space to Phase II, which includes a high-rise residential tower and a mixed-use office/residential tower.

“We’ve taken this a long way, so what you see is what we’ll build,” Smith said to the group of 56 Meninak members and guests meeting at the Doubletree by Hilton Hotel Jacksonville Riverfront.

Smith said the 175,000-square-foot office tower can support 800 employees. A parking garage will connect the Phase II buildings and a park is proposed for the site.

“As you can see, we’ve got residential heavily ingrained in our development here because we need that critical mass to make all this work,” Smith said.

The Jaguars and Cordish will need to find a tenant for the tower.

“The office building is really driving the Phase II development,” Smith said after the presentation. “If we’re successful in identifying an office tenant, we will build that office tower.”

Smith said there must be a market for the tower to start development.

“We can build a lot of things, but office you don’t want to speculate on,” Smith told Meninak members.

Jaguars President Mark Lamping told the Jacksonville Daily Record and Record & Observer on Jan. 21 that Phase II could be nearly $200 million on top of the Phase I Lot J investment, bringing the development to between $650 million and $700 million.

Future residential expansion is shown north of Lot J on what is now surface parking west of the stadium bordered by 121 Financial Ballpark.

Smith said Cordish is working with the Jaguars to incorporate a Jaguars retail store or a “Jags Fit” 24-hour fitness center into Lot J.

Other teams, including the San Francisco 49ers and Dallas Cowboys, have opened public NFL-branded fitness centers, according to Forbes.com.

The low-rise residential development would feature ground-floor restaurant space and the high-rise residential tower could have ground-floor retail, Smith said.

The developer also is in preliminary talks with a local grocery operator for a store at Lot J, Smith said. After his presentation, he said a 10,000- to 15,000-square-foot concept could work in the development.

Smith expects Lot J to create 1,000 construction jobs and 1,025 permanent jobs between the office tenants and hotel.

Project timeline

Smith said he expects a final development agreement with the city to be ready for consideration by the Downtown Investment Authority and City Council in the next 30 to 60 days after nearly a year of negotiations. He did not talk about details of that deal.

Mayor Lenny Curry’s administration has proposed $233.3 million in total city investment.

That includes $208 million toward the development of the Live! Arena, infrastructure improvements and a development grant.

Smith said crews could begin environmental remediation at Lot J by summer, but he doesn’t expect vertical construction until June 2021.

DIA board member Ron Moody is a Meninak member and will vote on the development agreement. He attended the March 2 meeting.

In a phone interview March 4, Moody said Smith’s presentation had the most information he’s seen on the Lot J and Shipyards proposal.

“It’s just the next step in what needs to take place in that area,” Moody said. “It is very encouraging. We’ve waited a long time but now we need to see some action.”

The Jaguars declined to provide the Daily Record images and renderings from Smith’s presentation.

Cordish portfolio

Smith began his real estate career with The Rouse Company, developer of The Jacksonville Landing. He joined Cordish in 2002.

Cordish partnered with professional sports teams, including the St. Louis Cardinals and the Texas Rangers, for multiphase, mixed-use developments anchored by the team stadiums.

The Cardinals partnership produced Ballpark Village, a seven-block entertainment, office and residential development adjacent to Busch Stadium.

Smith said Phase II of the Cardinals project is in development — a $260 million, 700,000-square-foot project that includes a Live! by Loews hotel, 29-story residential tower, and a Class A office building.

Smith told Meninak that taxpayer-backed investment from city partners is typical in Cordish developments.

Kansas City, Missouri, invested about $300 million in infrastructure improvements when it partnered with Cordish to develop the 14-block Power & Light District, Smith said.

Shipyards and beyond

Smith’s presentation offered new information on Lot J and the Shipyards since Lamping delivered the State of the Franchise on April 18, 2019.

Smith said waterfront residential development is the goal for the Shipyards project southwest of Lot J, and Cordish sees that as the best site for a Downtown convention center and hotel. The Jaguars have talked about a convention center on the site.

“Ultimately, we’ll have residential on the waterfront. We want to do a hotel with condominiums for sale, so those folks living there would have a priority on marina space,” Smith said.

For Cordish, it was the size of the combined developments that drew the company to partner with the Jaguars.

Smith said Cordish and the Jaguars are “shoulder-to-shoulder” on their investment.

In a response to a question from the Meninak audience, Smith said he doesn’t see the Jaguars’ decision to move a second home game to Wembley Stadium in London for the 2020 season as a precursor to the team leaving Jacksonville.

“We’re putting our money in, they’re putting their money in,” he said of the Lot J and Shipyards development.

“These kind of developments allow (the Jaguars) to generate more revenue. That’s their total focus here is how do they become more successful here in Jacksonville,” Smith said. “We certainly hope that the team stays here. We’re betting on the team staying here.”